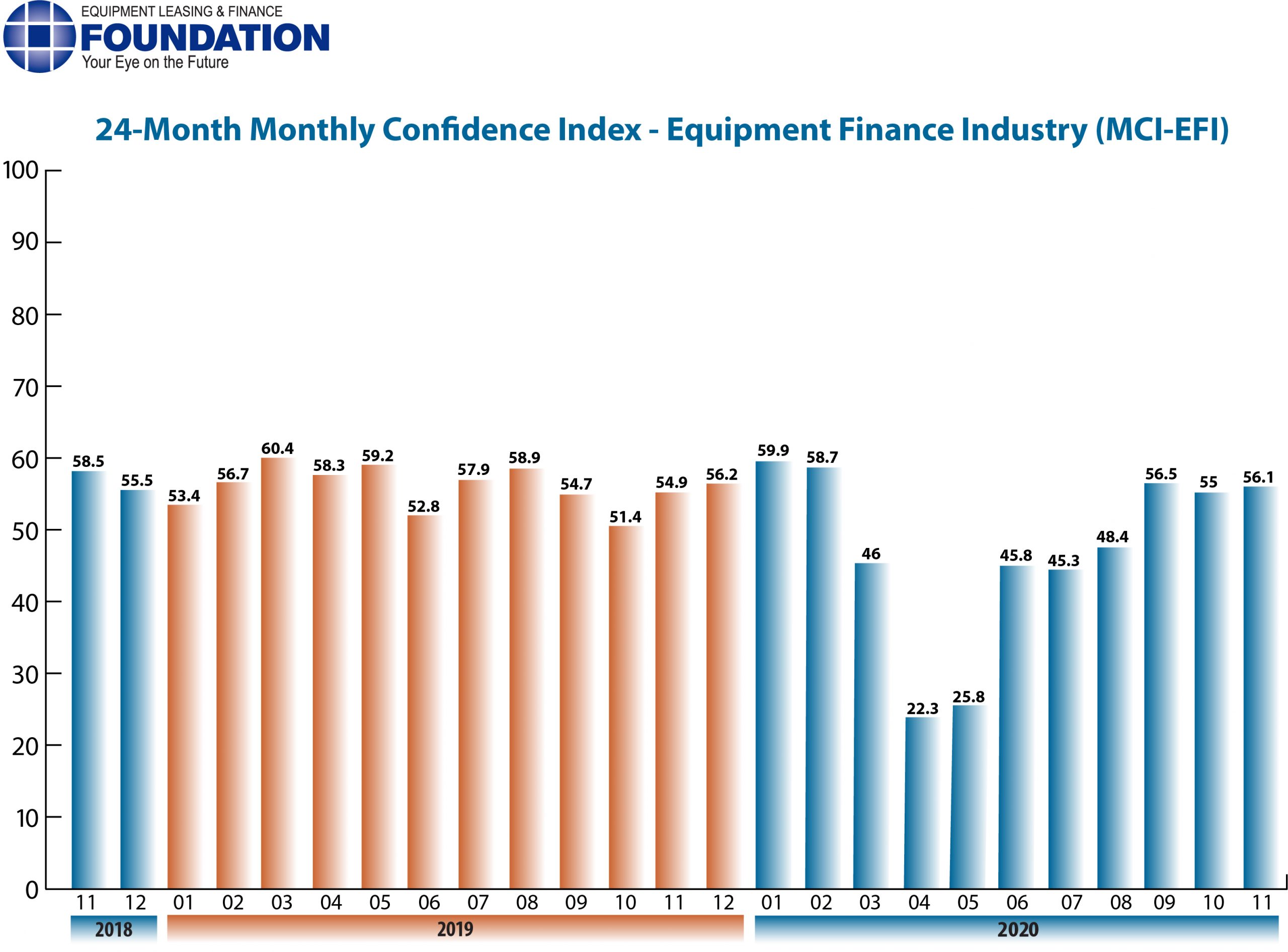

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 56.1, an increase from the October index of 55.0.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

[Note: Some MCI and COVID-19 Impact survey questionnaires and comments were submitted before Election Day results were publicized.]

When asked about the outlook for the future, MCI-EFI survey respondent Michael Romanowski, President, Farm Credit Leasing, said, “All eyes are on the election. Depending on what shakes out with the political environment will impact businesses’ longer-term plans for investment. The present environment is on shaky ground and fiscal stimulus is needed to stop the tremors.”

November 2020 Survey Results

The overall MCI-EFI is 56.1, an increase from the October index of 55.0.

- When asked to assess their business conditions over the next four months, 26.9% of executives responding said they believe business conditions will improve over the next four months, down from 29.6% in October. 53.9% believe business conditions will remain the same over the next four months, an increase from 51.9% the previous month. 19.2% believe business conditions will worsen, an increase from 18.5% in October.

- 19.2% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 22.2% in October. 69.2% believe demand will “remain the same” during the same four-month time period, an increase from 66.7% the previous month. 11.5% believe demand will decline, relatively unchanged from 11.1% in October.

- 23.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 33.3% in October. 76.9% of executives indicate they expect the “same” access to capital to fund business, an increase from 66.7% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 30.8% of the executives report they expect to hire more employees over the next four months, up from 25.9% in October. 57.7% expect no change in headcount over the next four months, a decrease from 63% last month. 11.5% expect to hire fewer employees, relatively unchanged from 11.1% in October.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 76.9% of the leadership evaluate the current U.S. economy as “fair,” up from 55.6% in October. 23.1% evaluate it as “poor,” down from 44.4% last month.

- 34.6% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 25.9% in October. 50% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 59.3% last month. 15.4% believe economic conditions in the U.S. will worsen over the next six months, up from 14.8% the previous month.

- In November, 26.9 % of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 22.2% last month. 69.2% believe there will be “no change” in business development spending, a decrease from 70.4% in October. 3.9% believe there will be a decrease in spending, down from 7.4% last month.

November 2020 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Following the distraction of the election, business will get re-focused on winning with whatever the new rules of engagement are and will continue to find ways to win.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Middle Ticket

“We believe better health outcomes related to the pandemic (therapeutics, forthcoming vaccine) coupled with more government stimulus will allow business formation and capital expenditures to return to a more normal pace.” Bruce J. Winter, President, FSG Capital, Inc.

Back to Top