Agricultural Machinery

Investment in Agricultural Machinery increased 47% (annualized) in Q1 2024 and is now 11% above its year-ago level. The Agriculture Momentum Index ticked down from 114.2 to 113.3 in July. In June, yellow corn futures were down 9.9% M/M, while poultry broiler exports were up 3.9% in May. Despite the modest decline, the Index’s current position and previous movement suggests that annual growth in agriculture machinery investment should remain strongly positive over the next two quarters.

Construction Machinery

Investment in Construction Machinery ticked up 0.5% (annualized) in Q1 2024 and is 1.8% above its year-ago level. The Construction Momentum Index fell again in July, from 100.9 to 97.2. In May, public construction spending ticked up 0.5%, while the value of construction machinery shipments fell 1.8% M/M. Overall, movement in the Index over recent months suggests that annual investment growth in construction machinery is likely to contract over the next two quarters.

Materials Handling Equipment

Investment in Materials Handling Equipment increased 5.4% (annualized) in Q1 2024 and is 2.1% above year-ago levels. The Materials Handling Momentum Index decreased from 87.1 in June to 85.0 in July. Manufacturing payrolls ticked down (-0.1%) in June, while prices for materials handling equipment rose 1.2% in May. Overall, the Index’s recent movement suggests that annual investment growth in materials handling equipment will weaken and could turn negative over the next six months.

Other Industrial Equipment

Investment in All Other Industrial Equipment increased 17% (annualized) in Q1 2024 and is slightly below year-ago levels (-0.8%). The Other Industrial Equipment Momentum Index increased from 90.4 in May to 93.9 in June. In March, equipment steel prices jumped 17% M/M, more than offsetting a slight contraction in private non-residential construction spending in April. Overall, the Index’s position and recent movement suggest that annual investment growth in other industrial equipment may have bottomed out and should begin to improve over the next six months.

Medical Equipment

Investment in Medical Equipment decreased 7.3% (annualized) in Q1 2024 but is up 0.5% on a Y/Y basis. The Medical Equipment Momentum Index fell sharply in July from 100.0 to 94.0. In May, medical equipment and supplies prices ticked down 0.3%, while the CPI for dental services rose 1.2% M/M. Overall, the Index’s sharp decline in recent months indicates that medical equipment investment growth will weaken and may turn negative over the next six months.

Mining & Oilfield Machinery

Investment in Mining & Oilfield Machinery decreased 25% (annualized) in Q1 2024 and is down 5.7% from year-ago levels. The Mining & Oilfield Machinery Momentum Index fell from 90.8 in June to 89.1 in July. 87.8 in June. Crude oil production eased 2.7% M/M in April, while mining and logging payrolls decreased. Overall, the Index suggests that annual growth in mining & oilfield machinery investment will remain negative over the next six months.

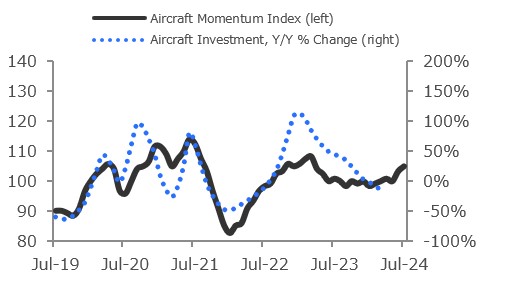

Aircraft

Investment in Aircraft decreased at a 76% (annualized) rate in Q1 2024 and is down 17% on an annual basis. The Aircraft Momentum Index increased from 103.3 to 105.0 in July. In May, exports of computer and electronic products rose 12.7% Y/Y, but the ISM New Orders index fell 12.6% in June. Overall, recent movement in the Index suggests that annual growth in aircraft investment should improve over the next two quarters.

Ships & Boats

Investment in Ships & Boats fell at a 29% annualized rate in Q1 2024 and is 21% below its year-ago level. The Ships & Boats Momentum Index increased from 97.6 in June to 99.2 in July. In May, the Producer Price Index for nonmilitary ship repair increased 2.8% M/M, while exports of ships and boats to Canada decreased 40% Y/Y. Overall, the Index’s current position suggests that annual growth in ships & boats investment may have bottomed out but is unlikely to turn positive over the next six months.

Railroad Equipment

Investment in Railroad Equipment increased sharply (+169% annualized) in Q1 2024 and is up 22% year-over-year. The Railroad Equipment Momentum Index increased from 94.5 to 95.3 in July. In June, rail carload originations of farm products excluding grain increased 2.7%, while capacity utilization for manufacturing transportation equipment rose. Overall, the Index points to steady railroad equipment investment growth over the coming six months.

Trucks

Investment in Trucks increased 7.7% (annualized) in Q1 2024 and is 6.0% above year-ago levels. The Trucks Momentum Index decreased from 103.2 to 100.8 in July. In May, heavy duty truck prices weakened 5.2%, while raw steel production decreased 1.0% in June. Overall, the Index indicates that annual investment growth in trucks should improve over the next six months.

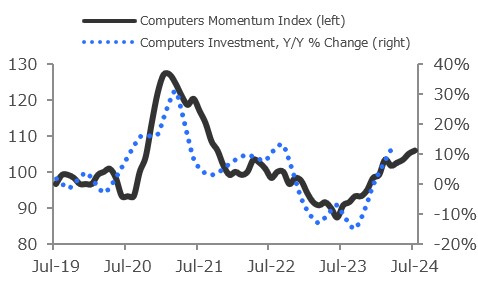

Computers

Investment in Computers increased 44% (annualized) in Q1 2024 and is up 11% on a year-over-year basis. The Computers Momentum Index ticked up from 105.1 in June to 105.9 in July. In June, the ISM Supplier Deliveries Index decreased 9.7% Y/Y, while the value of shipments of communication equipment increased 0.7% Y/Y in May. Overall, the Index’s current position and recent movement point to stronger year-over-year investment growth in computers over the next six months.

Software

Investment in Software rose 11% (annualized) in Q1 2024 and is up 8.8% from a year prior. The Software Momentum Index improved from 93.0 to 93.8 in July. In May, total revolving credit ticked up 0.5% M/M, while the national unemployment rate climbed to 4.1% in June. Overall, the Index points to solid annual growth in software investment over the next two quarters.