The Equipment Leasing & Finance Foundation developed the Impact of Bank Liquidity on the Equipment Finance Industry Survey which tracks the immediate and long-term impact of the recent bank liquidity crises on equipment finance companies on a variety of factors. This survey was open to responses during the month of April 2023. A total of 78 companies participated in this survey - 33 Banks, 33 Independents and 12 Captives.

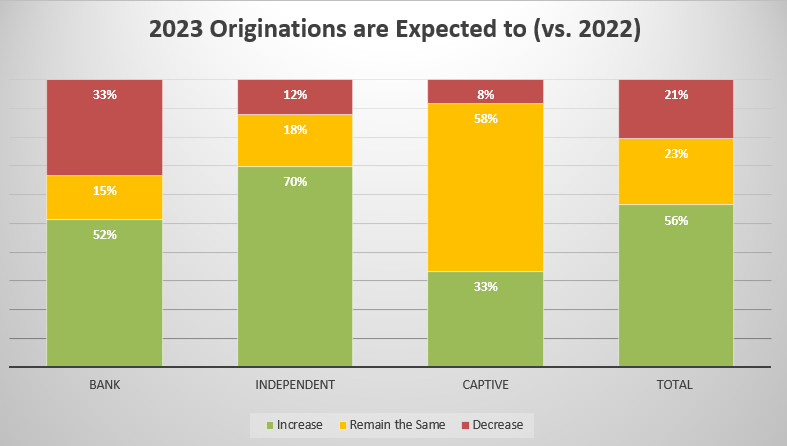

The equipment finance industry is seeing a negative impact on business conditions due to recent bank failures and their attendant liquidity issues. The survey reveals that despite the majority of lenders (56%) expecting originations volume to increase in 2023, substantially more banks and captives feel that the impact of recent events was negative rather than positive for them. Independents, however, believe they will have more opportunities if banks tighten or restrict their small business lending.

While the majority of equipment finance firms expect originations to increase in 2023, about of third of banks reported that originations will decline this year. Partly driving lower originations is a less active capital markets function as Banks reported that their buy desks are reducing their purchases of deals and portfolios. A reduction in Bank originations may be tied to the parent bank prioritizing depository relationships over new clients until market conditions stabilize. Such an action will likely benefit Independents as they will finance stronger credits typically financed through the bank leasing organizations. Perhaps that is why Independents expect an increase in their buy desk activities.

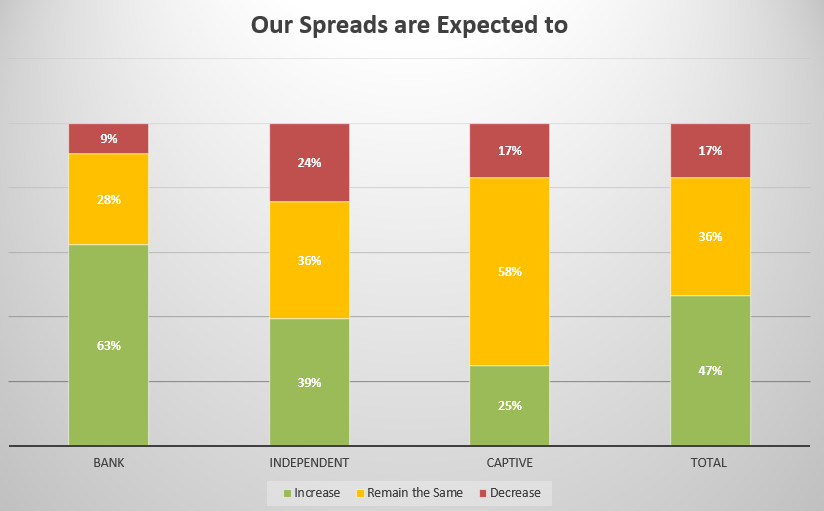

One clear impact of the market turmoil is higher margins or required spreads for Banks and Independents as well as elevated cost of capital. Captives, on the other hands, are mostly reporting these costs to remain about the same. Substantially more Banks and Captives felt that the impact of recent events was negative rather than positive for them, as one respondent wrote: “Banks are trying to get a handle on how big of an issue their asset vs. liability mismatch is. They are also worried about their commercial RE portfolios which is a real issue.”

While another wrote "The banks will add a liquidity premium to their rates to cover this issue." Within Banks, institution size also mattered “Large, money center banks are seeing the inflow of low or non-interest bearing deposits while smaller banks are having to borrow to maintain liquidity. This presents a challenge to smaller institutions to maintain adequate NIM.” Nancy Pistorio, President of Madison Capital LLC, however, spoke for most Independents when she said that "as an independent, if banks tighten up or restrict their small business lending, we will see more opportunities."

Survey Highlights are below:

Impact

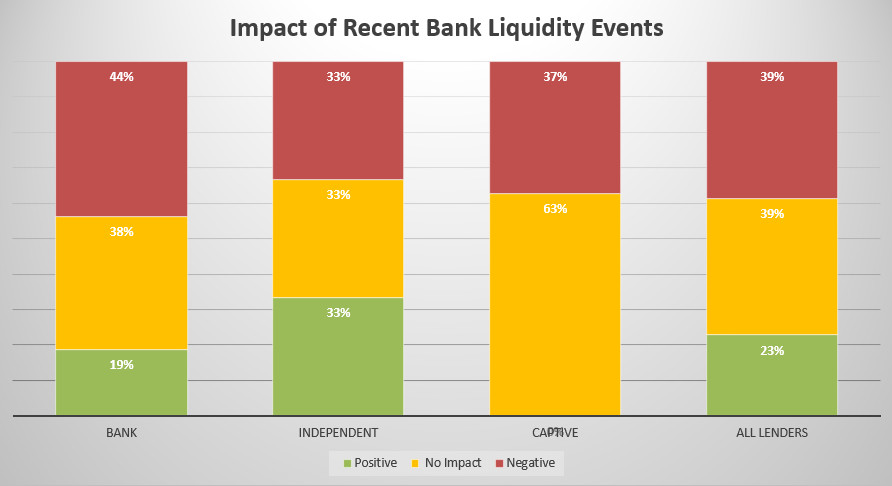

When asked how they expect to be impacted by the recent liquidity crisis 44% of Banks reported they expected a negative impact, 63% of Captives expected no impact. Independents were equally split on how they expected to be impacted.

Deposits

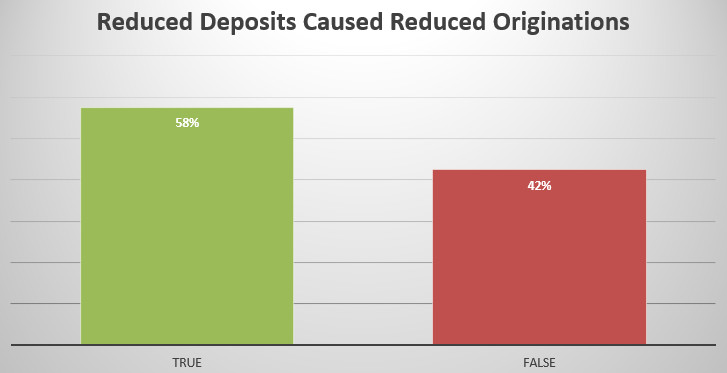

When asked if changes in deposit level would reduce new transaction origination and funding activity, 58% of Banks of believed they would.

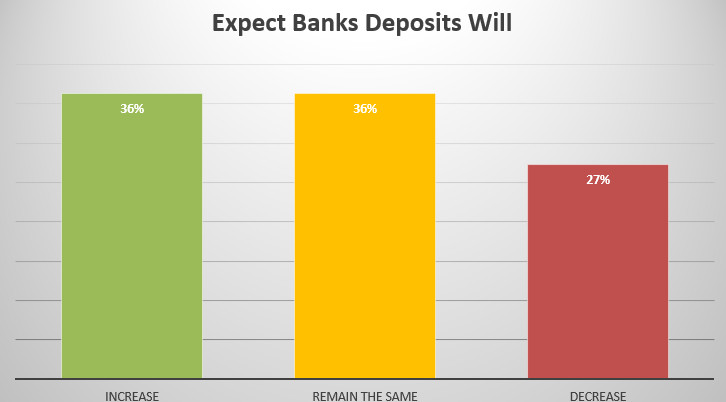

An equal amount of respondents expect deposits at their Banks to increase or remain the same.

Origination Volume Short & Long Term Impact

Despite these pressures, the majority of lenders expect originations volume to increase in 2023. There was a barbell among Bank lenders, however, with 52% expecting an increase, 33% a decrease, and only 15% expecting volume to remain the same.

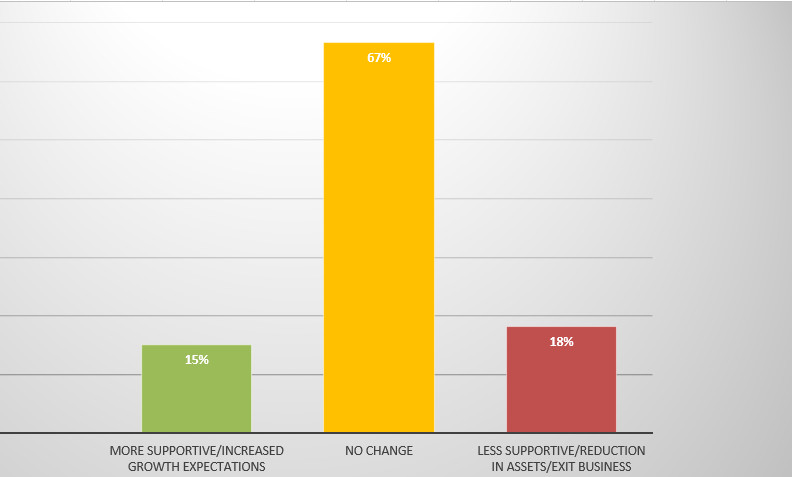

When bank owned leasing companies were asked what about expectations of business growth with respect to the equipment finance products, 67% reported they expected no change as result of the liquidity crisis.

Cost of Capital and Spreads

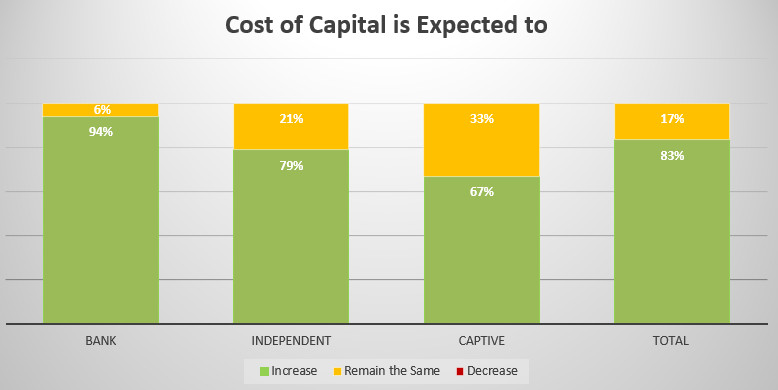

All types of institutions expect their cost of capital to increase.

While 63% of Banks and 39% of Independents believe their margin requirement or credit spread will increase, Captives were more likely to respond that they will remain the same.

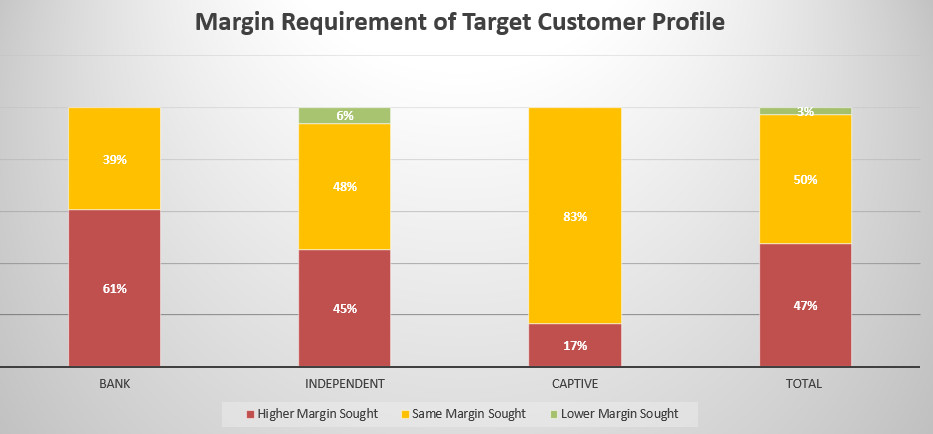

Credit Profiles and Margin Requirements

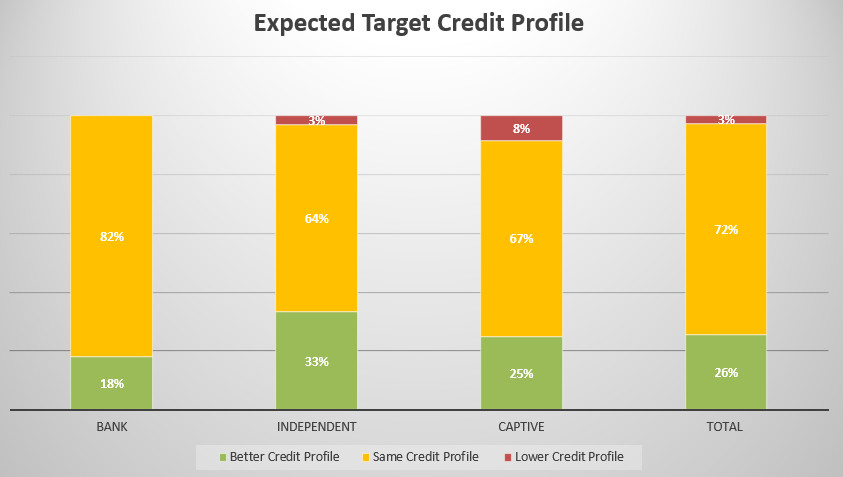

When asked if they expect the credit profile of their target customer to change, the majority of respondents reported they would be seeking the same credit profile.

When asked if they expect margin requirements of their target customer to change, 83% of Captives and 48% of Independents said they would seek the same margin while 61% of Banks said they would seek a higher margin.

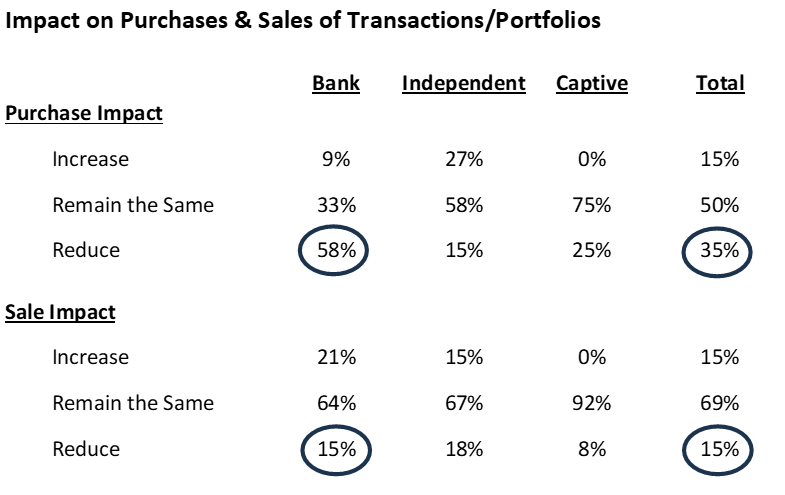

Impact on Purchases & Sales of Transactions/Portfolios

Most Banks, 58% said they would Reduce their Purchasing, but only 15% said they would Reduce their Selling, likely foretelling a market imbalance with more sellers than buyers. The difference was less extreme when all lender types are counted, with 35% saying they would Reduce Purchasing and only 15% saying they would Reduce Selling, but the difference is still material.

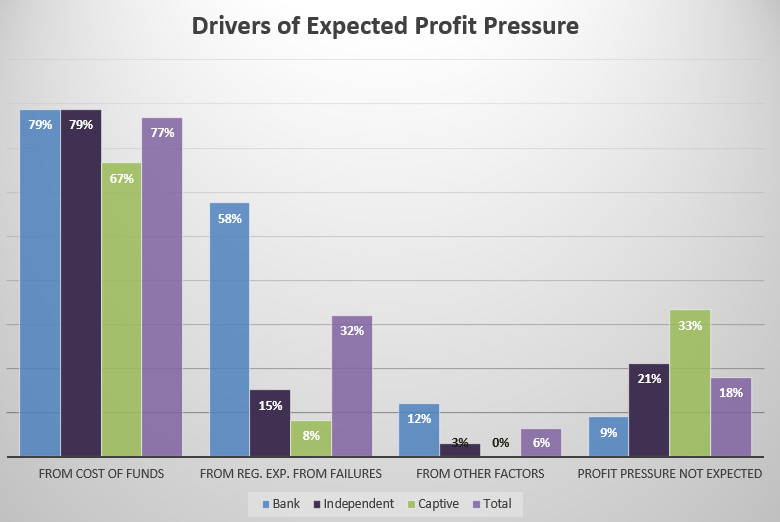

Profit Pressure and Purchase Impact

When asked if they expected profit pressure or erosion to to occur, the majority of respondents across all company types said pressure was most likely to come from cost of funds.

The majority of respondents across all company types believe their purchase impact will not be affected by liquidity stress on capital markets activity.

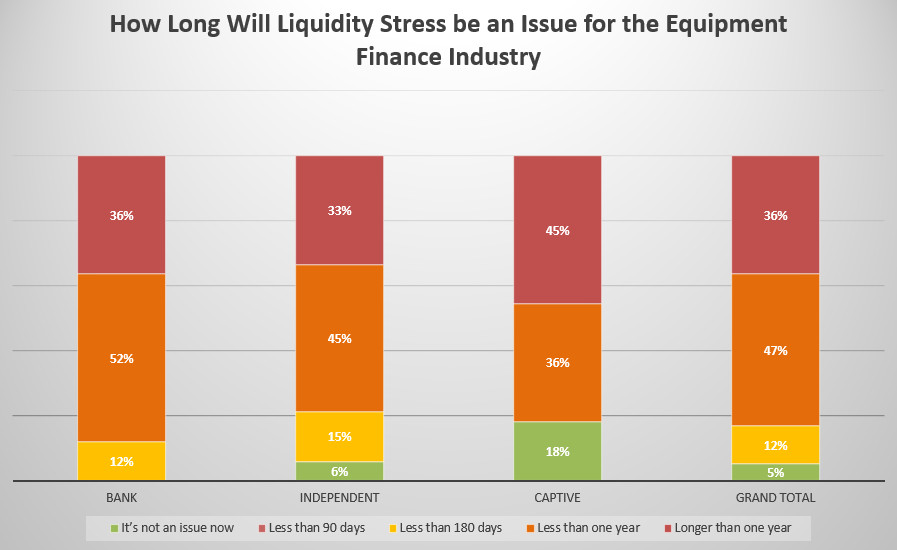

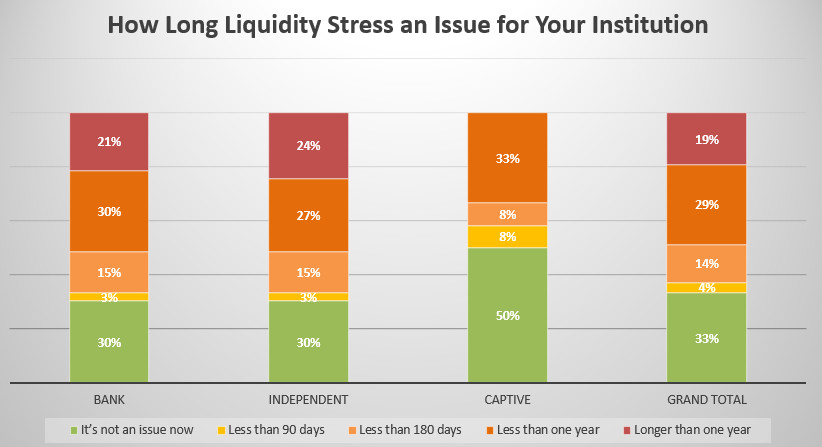

How Long Will Liquidity Stress be an Issue

When asked how long they believed liquidity stress will remain as an issue for the equipment finance industry, 83% say it will be an issue for at least half a year, and over a third say more than a year.

One-third say it's not an issue for their institution now, but 95% (and 100% of Banks) say it is an issue now for the industry.

Acknowledgments

We would like to acknowledge the support of the Equipment Leasing & Finance Foundation Research Committee volunteers who contributed to this survey and data analysis, including Chris Enbom, Valerie Gerard, Chris Kelley, Eli Sethre, Will Tefft, Tom Ware and Donna Yanuzzi.