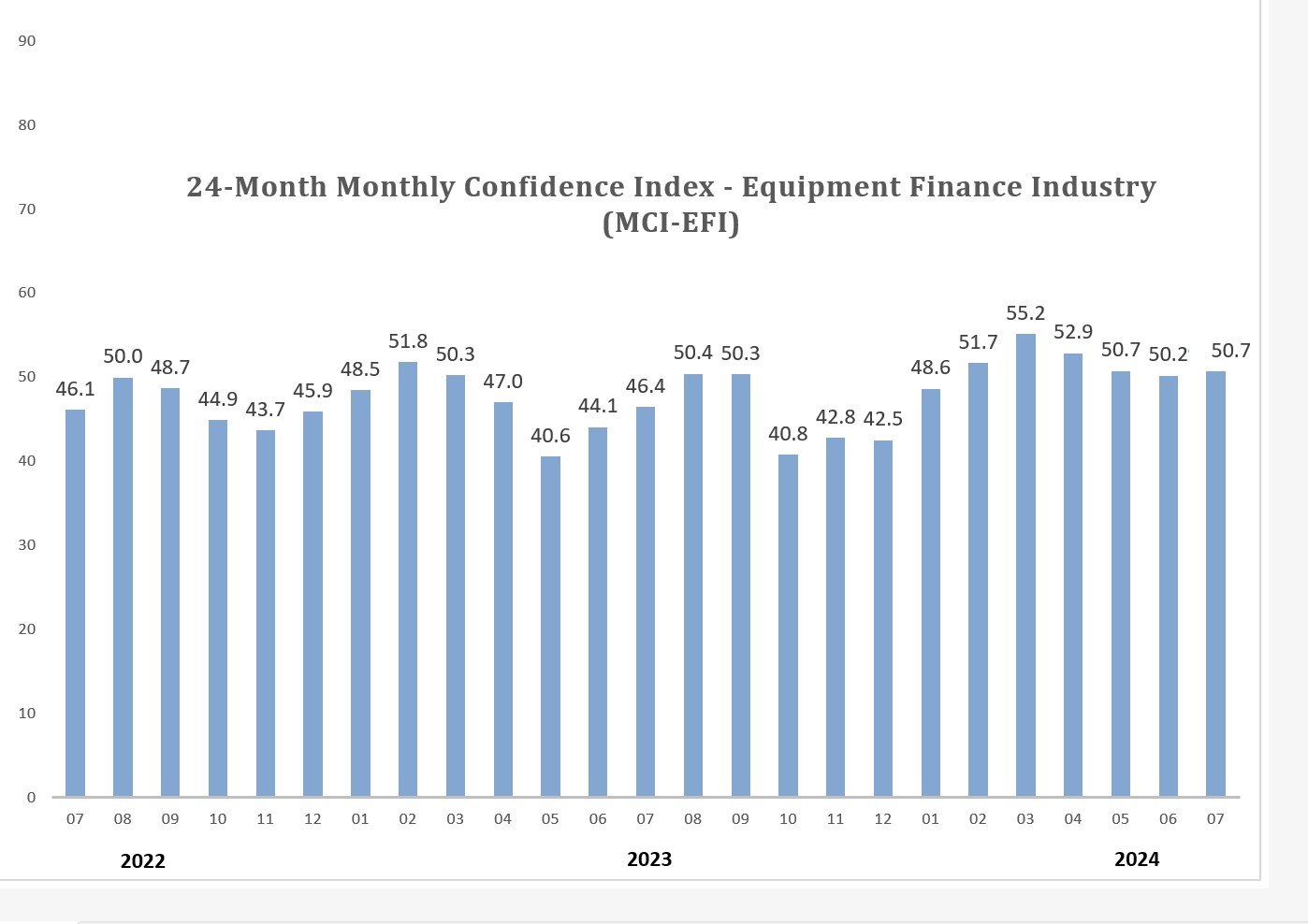

The Equipment Leasing & Finance Foundation (the Foundation) releases the July 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 50.7, steady with the May and June MCIs of 50.7 and 50.2, respectively. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Lyndon Thompson, President, Byline Financial Group, said, “Companies are falling behind on capex, but the need for replacement is necessary, despite rising costs and increased financing expenses. Upgrades are essential for growth and to stay competitive, though it’s unlikely costs will decrease in the foreseeable future.”

July 2024 Survey Results

The overall MCI-EFI is 50.7, steady with the June index of 50.2.

When asked to assess their business conditions over the next four months, 3.9% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 11.5% in June. 76.9% believe business conditions will remain the same over the next four months, unchanged from the previous month. 19.2% believe business conditions will worsen, up from 11.5% in June.

- 11.5% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 7.4% in June. 73.1% believe demand will “remain the same” during the same four-month time period, down from 77.8% the previous month. 15.4% believe demand will decline, a slight increase from 14.8% in June.

- 19.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from June. 76.9% of executives indicate they expect the “same” access to capital to fund business, up from 73.1% last month. 3.9% expect “less” access to capital, down from 7.7% the previous month.

- When asked, 23.1% of the executives report they expect to hire more employees over the next four months, a decrease from 25.9% in June. 69.2% expect no change in headcount over the next four months, up from 66.6% last month. 7.7% expect to hire fewer employees, relatively unchanged from June.

- None of the leadership evaluate the current U.S. economy as “excellent,” down from 3.9% the previous month. 84.6% of the leadership evaluate the current U.S. economy as “fair,” up from 76.9% in June. 15.4% evaluate it as “poor,” down from 19.2% last month.

- 19.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 14.8% in June. 57.7% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 48.2% last month. 23.1% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 37% the previous month.

- In July, 19.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 14.8% the previous month. 73.1% believe there will be “no change” in business development spending, down from 77.8% in June. 7.7% believe there will be a decrease in spending, relatively unchanged from last month.

Survey Demographics

Market Segment

- Bank 53.8%

- Captive 7.7%

- Independent 38.4%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 11.5%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 38.4%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 50%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 11.5%

- $50 Million – $250 Million 19.2%.

- $250 Million – $1 Billion 34.6%

- Over $1 Billion 34.6%

July 2024 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“The current environment in small ticket equipment leasing is testing business models. Some will demonstrate a strong resilience and others will illustrate portfolio performance issues. Either way, times of stress strengthen business practices and make our industry stronger in the long run. I am confident that the equipment leasing and finance industry will become stronger and adapt to continue to meet the needs of our customers in new ways.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Independent, Small Ticket

“My main concern is the Fed will remain stubbornly restrictive and overshoot sticking to a 2% inflation mandate. Very little makes me optimistic, with the impending election most likely causing a stalemate.” Mark Bonanno, President and Chief Operating Officer, North Mill Equipment Finance

“Inflation (higher than acceptable), high interest rates, and robust federal government spending continue to put a drag on the economy.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Back to Top