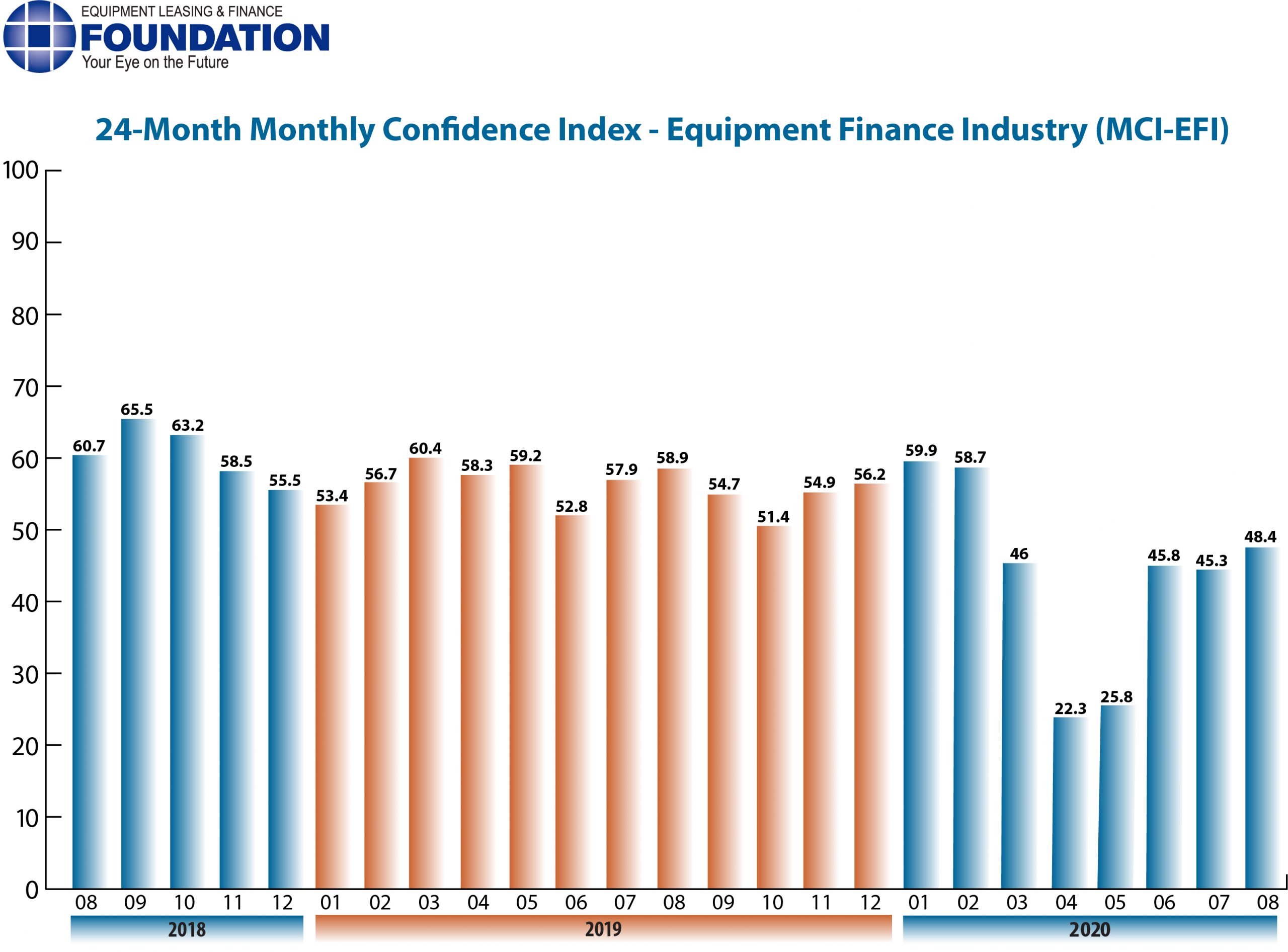

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 48.4, an increase from the July index of 45.3.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Brian Madison, President, TrinityRail Leasing & Management Services, said, “To date, receivables have held up surprisingly well, which seems to indicate businesses were relatively healthy entering the crisis. The biggest concern is continued limited demand given the amount of uncertainty related to the spread of COVID-19.”

August 2020 Survey Results

The overall MCI-EFI is 48.4, an increase from the July index of 45.3.

- When asked to assess their business conditions over the next four months, 24.1% of executives responding said they believe business conditions will improve over the next four months, up from 21.4% in July. 51.7% believe business conditions will remain the same over the next four months, an increase from 50% the previous month. 24.1% believe business conditions will worsen, a decrease from 28.6% in July.

- 13.8% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 14.3% in July. 65.5% believe demand will “remain the same” during the same four-month time period, an increase from 64.3% the previous month. 20.7% believe demand will decline, a decrease from 21.4% in July.

- 17.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 10.7% in July. 75.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 78.6% last month. 6.9% expect “less” access to capital, a decrease from 10.7% the previous month.

- When asked, 13.8% of the executives report they expect to hire more employees over the next four months, up from 7.1% in July. 69% expect no change in headcount over the next four months, a decrease from 75% last month. 17.2% expect to hire fewer employees, down slightly from 17.9% the previous month.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 48.3% of the leadership evaluate the current U.S. economy as “fair,” up from 39.3% in July. 51.7% evaluate it as “poor,” down from 60.7% last month.

- 31% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 25.9% in July. 44.8% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 55.6% last month. 24.1% believe economic conditions in the U.S. will worsen over the next six months, up from 18.5% the previous month.

- In August, 31% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 21.4% last month. 48.3% believe there will be “no change” in business development spending, a decrease from 57.1% in July. 20.7% believe there will be a decrease in spending, down from 21.4% last month.

August 2020 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Increased certainty following the presidential election this year will increase confidence as will more informed clarity regarding the COVID pandemic.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Bank, Middle Ticket

“We are continuing to see opportunities in the marketplace. We have seen some delay on projects; however, we have also seen an increase in opportunities with customers who were considering paying for investments with cash and are now looking to finance.” Michael Romanowski, President, Farm Credit Leasing

“There are numerous industry sectors that are performing well during the pandemic and are requiring financing for new equipment needs. The pandemic continues to challenge our economy and no one knows for sure how long that will last, but we’ll continue to be there for our customers every day.” John Wolfe, Group Manager, M&T Commercial Bank

Back to Top