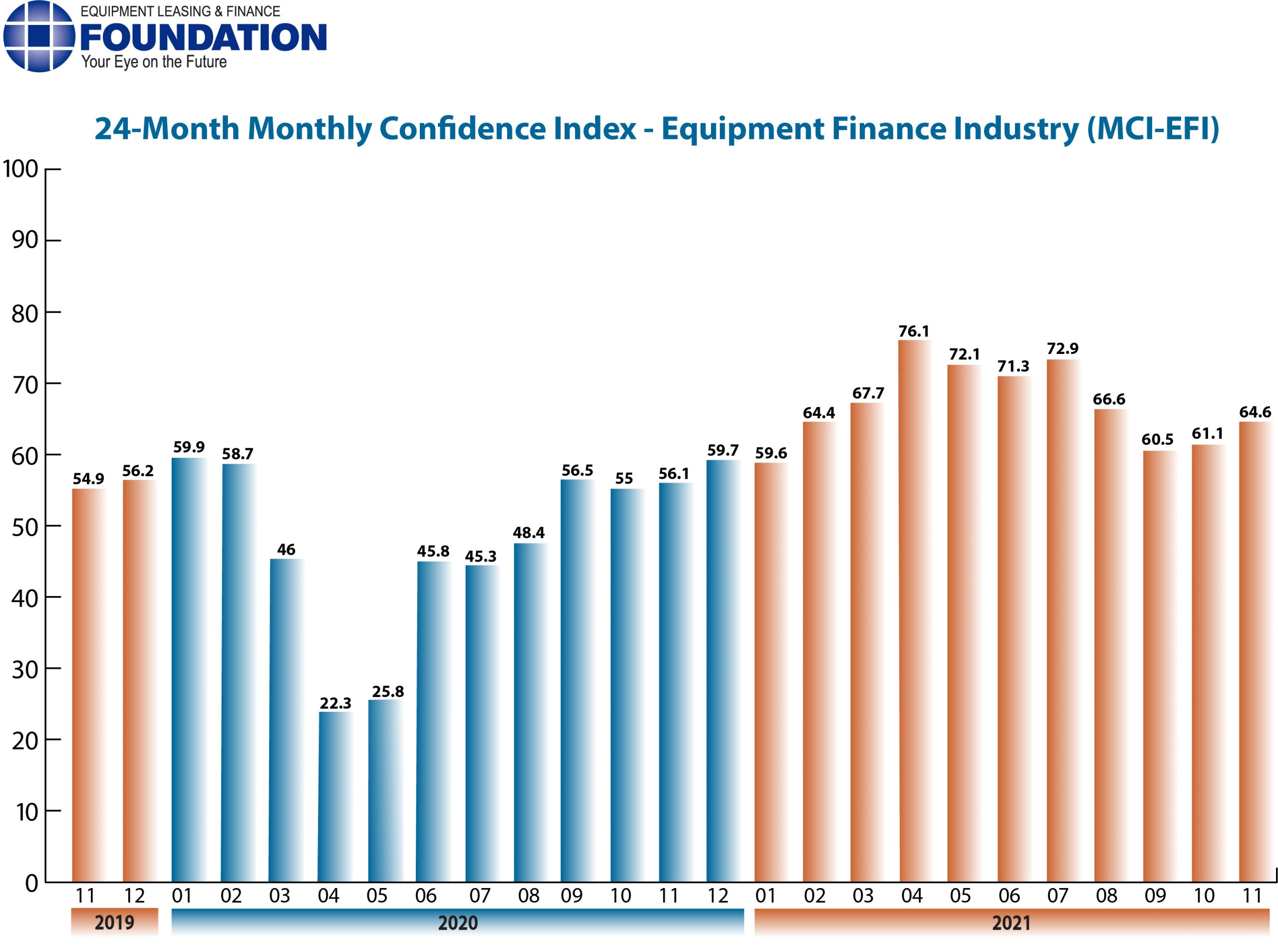

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 64.6, an increase from the October index of 61.1.

When asked about the outlook for the future, MCI-EFI survey respondent Dave Fate, Chief Executive Officer, Stonebriar Commercial Finance, said, “While I believe the equipment leasing and finance Industry will always perform well through various cycles, the last few months have shown a number of interesting data points. Strong corporate earnings continue to drive the equity markets. The current rise in Inflation rates is alarming and seems like it will be with us for a while. Continued issues with the lack of skilled and non-skilled labor are the number one concern of most of our customers. Supply chain issues are causing real disruption and seem to have no viable plan to alleviate them. The rest of Q4 and into Q1 will be very interesting as we navigate through year-end closing in our industry and the Christmas holiday season.”

November 2021 Survey Results

The overall MCI-EFI is 64.6, an increase from the October index of 61.1.

- When asked to assess their business conditions over the next four months, 34.6% of executives responding said they believe business conditions will improve over the next four months, up from 25.9% in October. 46.2% believe business conditions will remain the same over the next four months, down from 70.4% the previous month. 19.2% believe business conditions will worsen, up from 3.7% in October.

- 42.3% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 22.2% in October. 50% believe demand will “remain the same” during the same four-month time period, a decrease from 74.1% the previous month. 7.7% believe demand will decline, up from 3.7 in October.

- 26.9% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 14.8% in October. 73.1% of executives indicate they expect the “same” access to capital to fund business, a decrease from 85.2% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 53.9% of the executives report they expect to hire more employees over the next four months, up from 40.7% in October. 46.2% expect no change in headcount over the next four months, a decrease from 59.3% last month. None expect to hire fewer employees, unchanged from October.

- 15.4% of the leadership evaluate the current U.S. economy as “excellent,” an increase from 7.4% the previous month. 80.8% of the leadership evaluate the current U.S. economy as “fair,” down from 81.5% in October. 3.9% evaluate it as “poor,” down from 11.1% last month.

- 23.1% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 22.2% in October. 57.7% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 63% from last month. 19.2% believe economic conditions in the U.S. will worsen over the next six months, up from 14.8% the previous month.

- In November 42.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down slightly from 42.9% the previous month. 57.7% believe there will be “no change” in business development spending, up slightly from 57.1% in October. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 57.7%

- Captive 7.7%

- Independent 34.6%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 19.2%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 42.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 38.4%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 7.7%

- $50 Million – $250 Million 19.2%.

- $250 Million – $1 Billion 23%

- Over $1 Billion 50%

November 2021 Survey Comments from Industry Executive Leadership

Bank, Middle Ticket

“We continue to see interest in capital expansion for the sectors we serve, especially with middle market customers. Supply chain issues continue to be a headwind to the implementation of capital investment.” Michael Romanowski, President, Farm Credit Leasing

Independent, Middle Ticket

“Business owners are feeling much more confident and are moving forward with capital acquisitions, some that had been delayed because of the pandemic. Pending no flare up of COVID-19 infections in the coming months, we expect smooth sailing for the next several quarters.” Bruce J. Winter, President, FSG Capital, Inc.

Back to Top