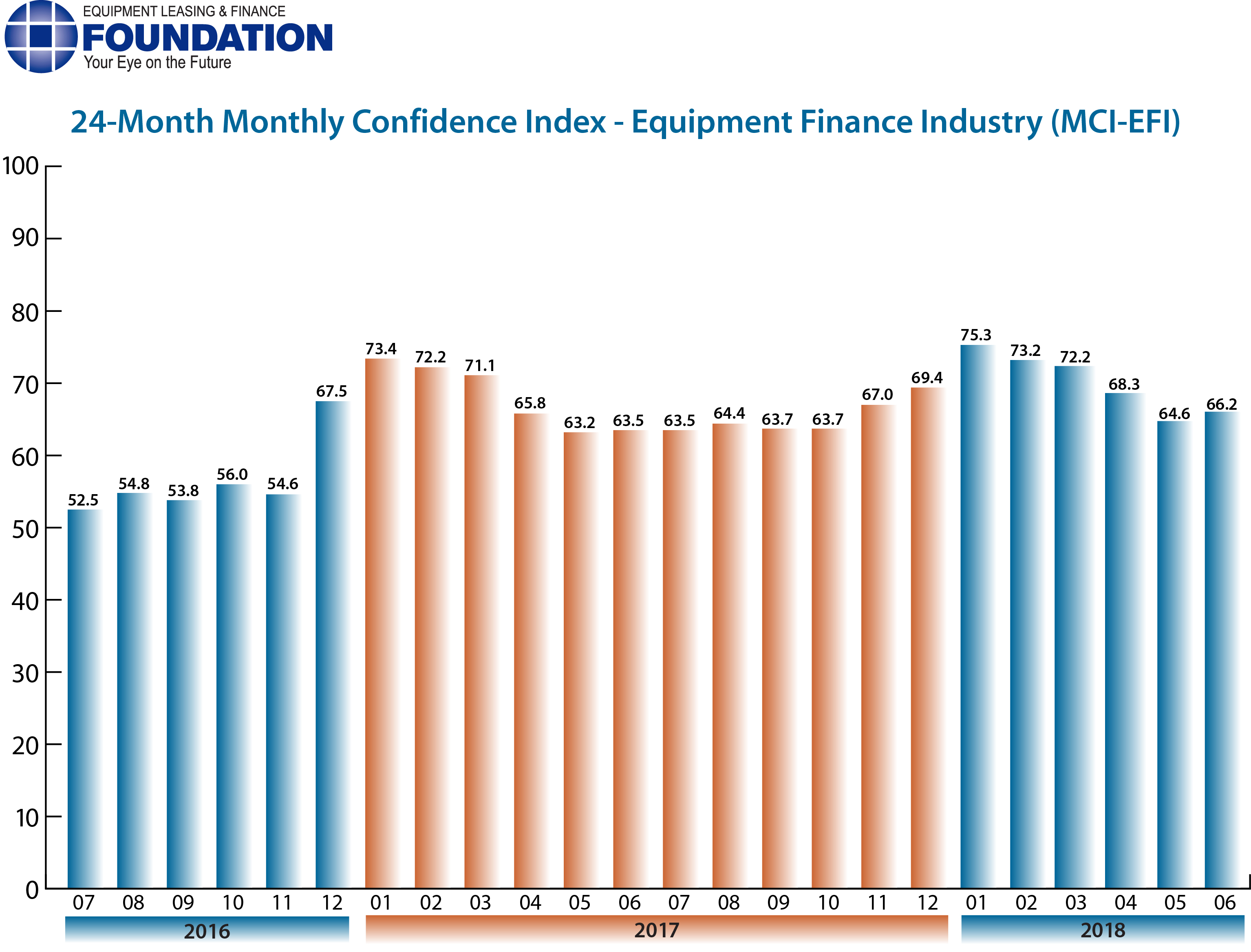

The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2018 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 66.2 in June, up from the May index of 64.6.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, said, “We are still experiencing strong demand. Current and almost certain future interest rate hikes seem to be driving the marketplace. We keep hearing from our customers that they need to get projects moving before financing costs rise. We see strong expansion of many small businesses with many current customers coming back for additional approvals. All signs are ‘go’ at the midpoint of this year!”

Survey Results

The overall MCI-EFI is 66.2 in June, an increase from 64.6 in May.

- When asked to assess their business conditions over the next four months, 33.3% of executives responding said they believe business conditions will improve over the next four months, an increase from 22.2% in May. 63.6% of respondents believe business conditions will remain the same over the next four months, a decrease from 74.1% the previous month. 3.0% believe business conditions will worsen, down slightly from 3.7% who believed so the previous month.

- 24.2% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 29.6% in May. 75.8% believe demand will “remain the same” during the same four-month time period, an increase from 70.4% the previous month. None believe demand will decline, unchanged from May.

- 15.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 25.9% in May. 84.9% of executives indicate they expect the “same” access to capital to fund business, an increase from 74.1% last month. None expect “less” access to capital, unchanged from last month.

- When asked, 57.6% of the executives report they expect to hire more employees over the next four months, an increase from 44.4% in May. 42.4% expect no change in headcount over the next four months, a decrease from 55.6% last month. None expect to hire fewer employees, unchanged from May.

- 39.4% of the leadership evaluate the current U.S. economy as “excellent,” up from 22.2% last month. 60.6% of the leadership evaluate the current U.S. economy as “fair,” down from 77.8% in May. None evaluate it as “poor,” unchanged from last month.

- 24.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 25.9% in May. 69.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a slight decrease from 70.4% the previous month. 6.1% believe economic conditions in the U.S. will worsen over the next six months, an increase from 3.7% in May.

- In June, 42.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 37% in May. 57.6% believe there will be “no change” in business development spending, a decrease from 63% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 60.61%

- Captive 12.12%

- Financial Services 3.03%

- Independent 21.21%

- Other 3.03%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 21.21%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 51.52%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 27.27%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 9.09%

- $50 Million – $250 Million 12.12%

- $250 Million – $1 Billion 21.21%

- Over $1 Billion 57.58%

Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“With business confidence and employment growth high we are expecting demand for equipment to grow. Portfolio performance is stable as are approval rates on new applications.” David T. Schaefer, CEO, Mintaka Financial, LLC

Bank, Small Ticket

“Continuing strong relationship building throughout the world will continue to increase confidence in the market and drive optimism.” David Normandin, CLFP, Managing Director, Commercial Finance Group, Hanmi Bank

Bank, Middle Ticket

“Year to date, the industry has experienced solid growth. However, I don’t believe the industry has yet to realize the full benefit of the 2017 tax legislation. Many companies are still adjusting to the new tax structure and the increased cash on their balance sheet. In some cases this cash surplus has reduced the propensity to finance. I expect the full effect of the tax package will benefit the industry in the second half of 2018 and 2019.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top