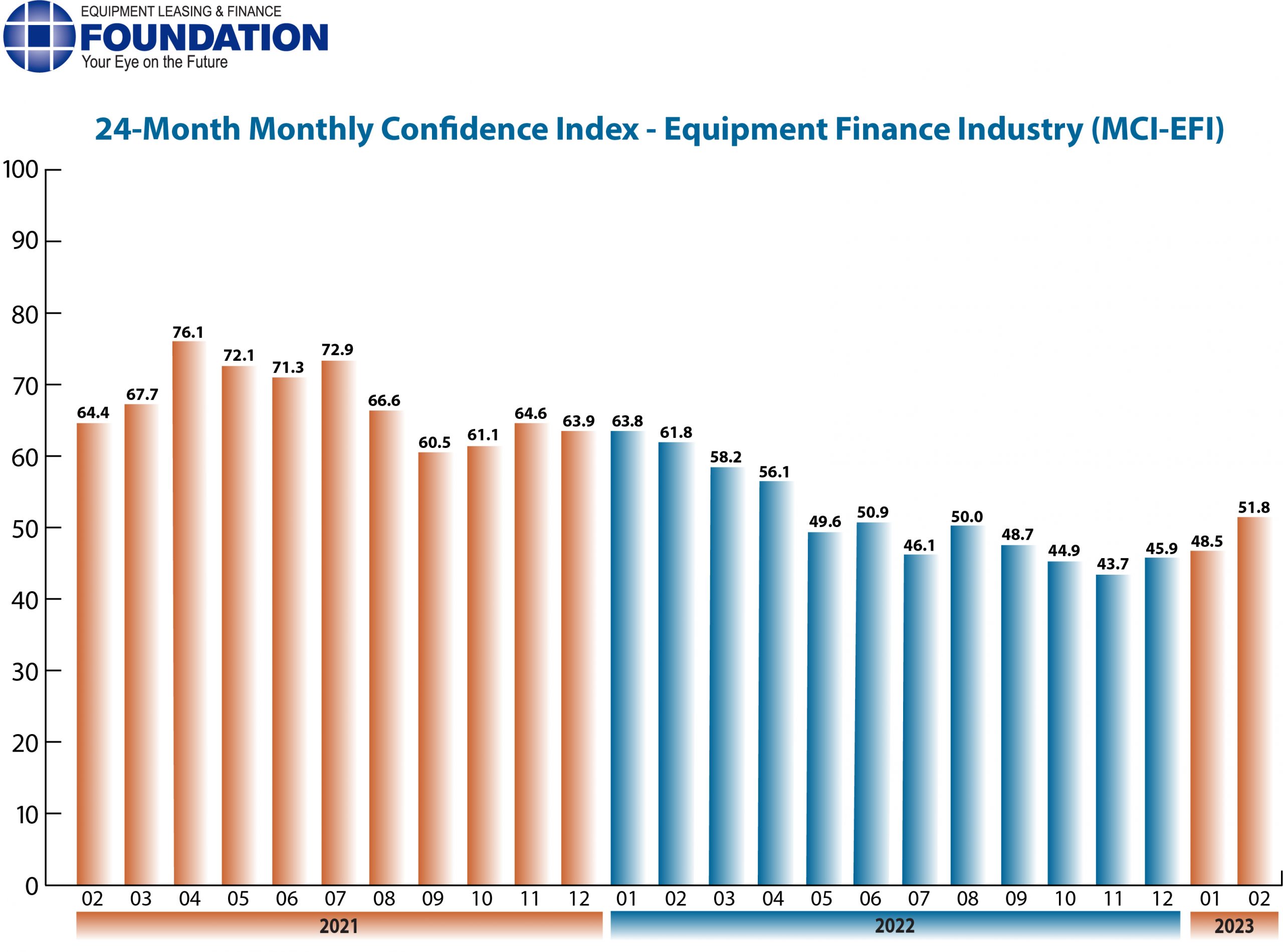

The Equipment Leasing & Finance Foundation (the Foundation) releases the February 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 51.8, an increase from the January index of 48.5.

When asked about the outlook for the future, MCI-EFI survey respondent Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc., said, “We still see pent-up demand in the light and medium-duty segment of transportation. However, we feel it will wane by the third or fourth quarter of this year.”

February 2023 Survey Results

The overall MCI-EFI is 51.8, an increase from the January index of 48.5.

When asked to assess their business conditions over the next four months, 16.1% of the executives responding said they believe business conditions will improve over the next four months, an increase from none in January. 61.3% believe business conditions will remain the same over the next four months, down from 69.2% the previous month. 22.6% believe business conditions will worsen, a decrease from 30.8 % in January.

- 9.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from none in January. 71% believe demand will “remain the same” during the same four-month time period, a decrease from 88.5% the previous month. 19.4% believe demand will decline, up from 11.5% in January.

- 12.9% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 11.5% in January. 74.2% of executives indicate they expect the “same” access to capital to fund business, an increase from 73.1% last month. 12.9% expect “less” access to capital, down from 15.4% the previous month.

- When asked, 38.7% of the executives report they expect to hire more employees over the next four months, unchanged from January. 54.8% expect no change in headcount over the next four months, a decrease from 61.5% last month. 6.5% expect to hire fewer employees, up from none in January.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 87.1% of the leadership evaluate the current U.S. economy as “fair,” up from 84.6% in January. 12.9% evaluate it as “poor,” a decrease from 15.4% last month.

- 3.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 7.7% in January. 54.8% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 57.7% last month. 41.9% believe economic conditions in the U.S. will worsen over the next six months, an increase from 34.6% the previous month.

- In February 51.6% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 23.1% the previous month. 41.9% believe there will be “no change” in business development spending, down from 73.1% in January. 6.5% believe there will be a decrease in spending, up from 3.9% last month.

Survey Demographics

Market Segment

- Bank 46.7%

- Captive 13.3%

- Independent 40%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 6.5%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 51.6%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 41.9%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 19.3%

- $50 Million – $250 Million 12.9%.

- $250 Million – $1 Billion 29%

- Over $1 Billion 38.7%

February 2023 Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“Recession is likely staying on the sidelines as long as there is a shortage of employees to fill open job positions.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Back to Top