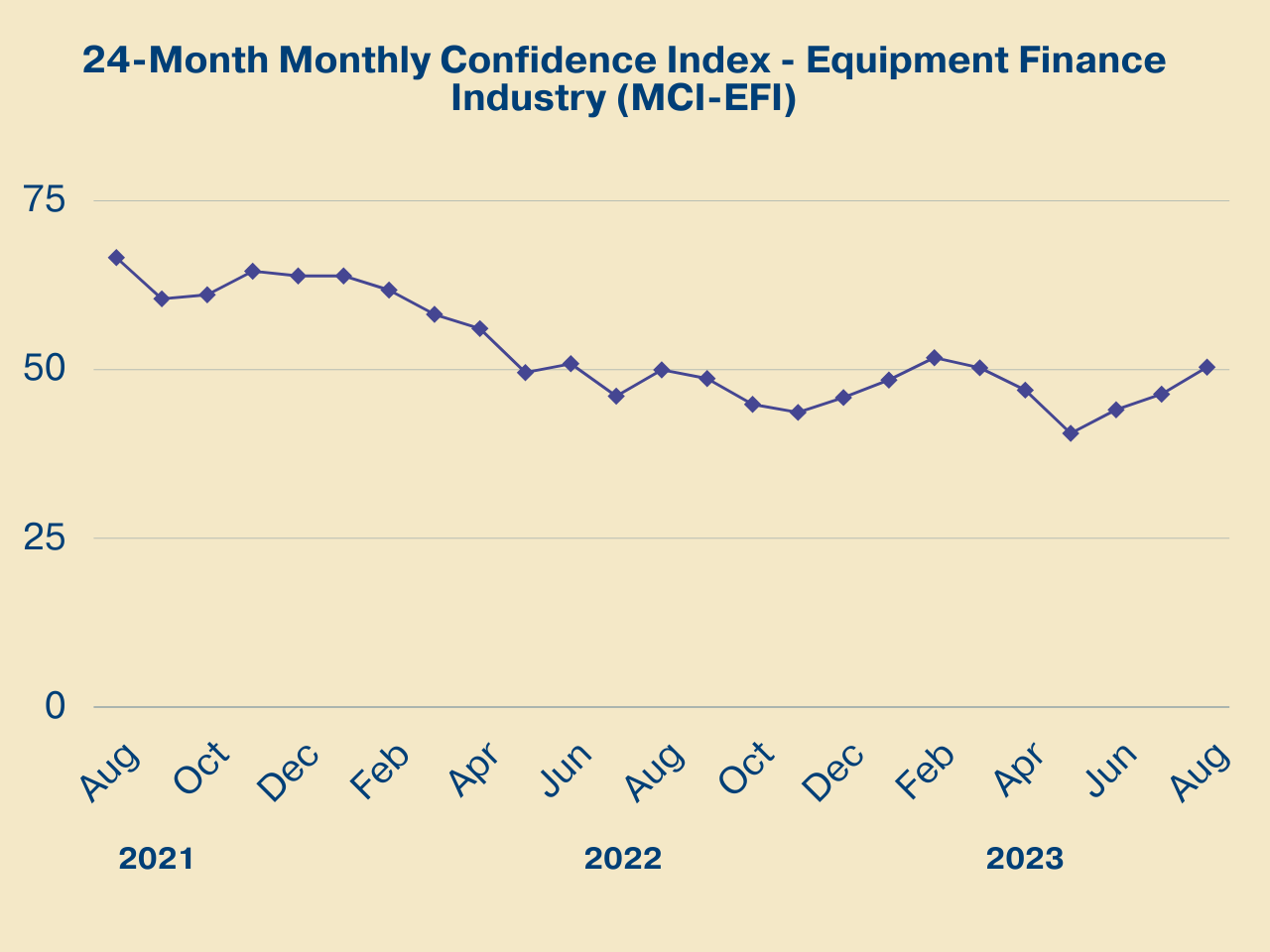

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 50.4, an increase from the July index of 46.4.

When asked about the outlook for the future, MCI-EFI survey respondent Dave Fate, CEO, Stonebriar Commercial Finance, said, “In spite of significant turmoil in the U.S. banking sector, including multiple downgrades and warnings from the rating agencies, as well as unprecedented interest rate increases over the past year, the equipment leasing and finance industry continues to persevere. Secured equipment loans and leases continue to outperform every other asset class. I would expect our industry to continue to deploy much-needed capital—which serves as a catalyst for the U.S. economy—across a diverse set of industries across the credit spectrum. Stonebriar continues to thrive in this environment with year-to-date originations through July 31 of $1.26 billion, up 28% year over year.”

August 2023 Survey Results

The overall MCI-EFI is 50.4, an increase from the July index of 46.4.

- When asked to assess their business conditions over the next four months, 3.6% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 7.7% in July. 89.3% believe business conditions will remain the same over the next four months, up from 65.4% the previous month. 7.1% believe business conditions will worsen, a decrease from 26.9% in July.

- 10.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 7.7% in July. 78.6% believe demand will “remain the same” during the same four-month time period, an increase from 69.2% the previous month. 10.7% believe demand will decline, down from 26.7% in July.

- 7.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 7.7% in July. 78.6% of executives indicate they expect the “same” access to capital to fund business, up from 76.9% last month. 14.3% expect “less” access to capital, down from 15.4% the previous month.

- When asked, 22.2% of the executives report they expect to hire more employees over the next four months, an increase from 15.4% in July. 70.4% expect no change in headcount over the next four months, down from 76.9% last month. 7.4% expect to hire fewer employees, down slightly from 7.7% in July.

- 3.6% of the leadership evaluate the current U.S. economy as “excellent,” relatively unchanged from 3.9% the previous month. 85.7% of the leadership evaluate the current U.S. economy as “fair,” up from 80.8% in July. 10.7% evaluate it as “poor,” a decrease from 15.4% last month.

- 10.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 11.5% in July. 60.7% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 53.9% last month. 28.6% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 34.6% the previous month.

- In August, 25% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 26.9% the previous month. 67.9% believe there will be “no change” in business development spending, up from 61.5% in July. 7.1% believe there will be a decrease in spending, down from 11.5% last month.

Survey Demographics

Market Segment

- Bank 5o%

- Captive 10.7%

- Independent 39.3%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 10.7%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 35.7%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 53.5%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 14.3%

- $50 Million – $250 Million 17.8%.

- $250 Million – $1 Billion 25.5%

- Over $1 Billion 39.3%

August 2023 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Hanmi’s Leasing Department continues to see steady demand for its funding services and as rates have started to stabilize, pricing has become less of an issue. We are fortunate to have long standing partners that are loyal and experienced originators. Increased delinquency and default rates from recent historic lows have our attention as potential concerns and we continue to monitor our portfolio closely.” Mike Coon, CLFP, First Vice President – Portfolio Manager. Hanmi Bank

Independent, Middle Ticket

“In the past three years, our industry was directly affected by three major issues: Covid, the unprecedented speed and size of Fed rate hikes, and the unexpected fallout from deposit stickiness in the banking industry. After each occurrence, the confidence index for our industry dropped and then after a few months started to recover. What this tells us is that we aren’t immune to these strong forces, but after they happen our industry reacts and finds a way to deal with them. This past resilience and agility are what give me confidence in the near-term future of our industry. There remain macro forces out there that we cannot control which could potentially impact every industry. These include an escalation of the war in Ukraine, further aggressive rate moves by the Fed, and the potential crisis involving loan refinancing for commercial office buildings. All of these are big unknowns, but if the past is a guidepost for the future, our industry will find a way to succeed.” Mike Rooney, Chief Executive Officer, Verdant Commercial Capital LLC

Back to Top