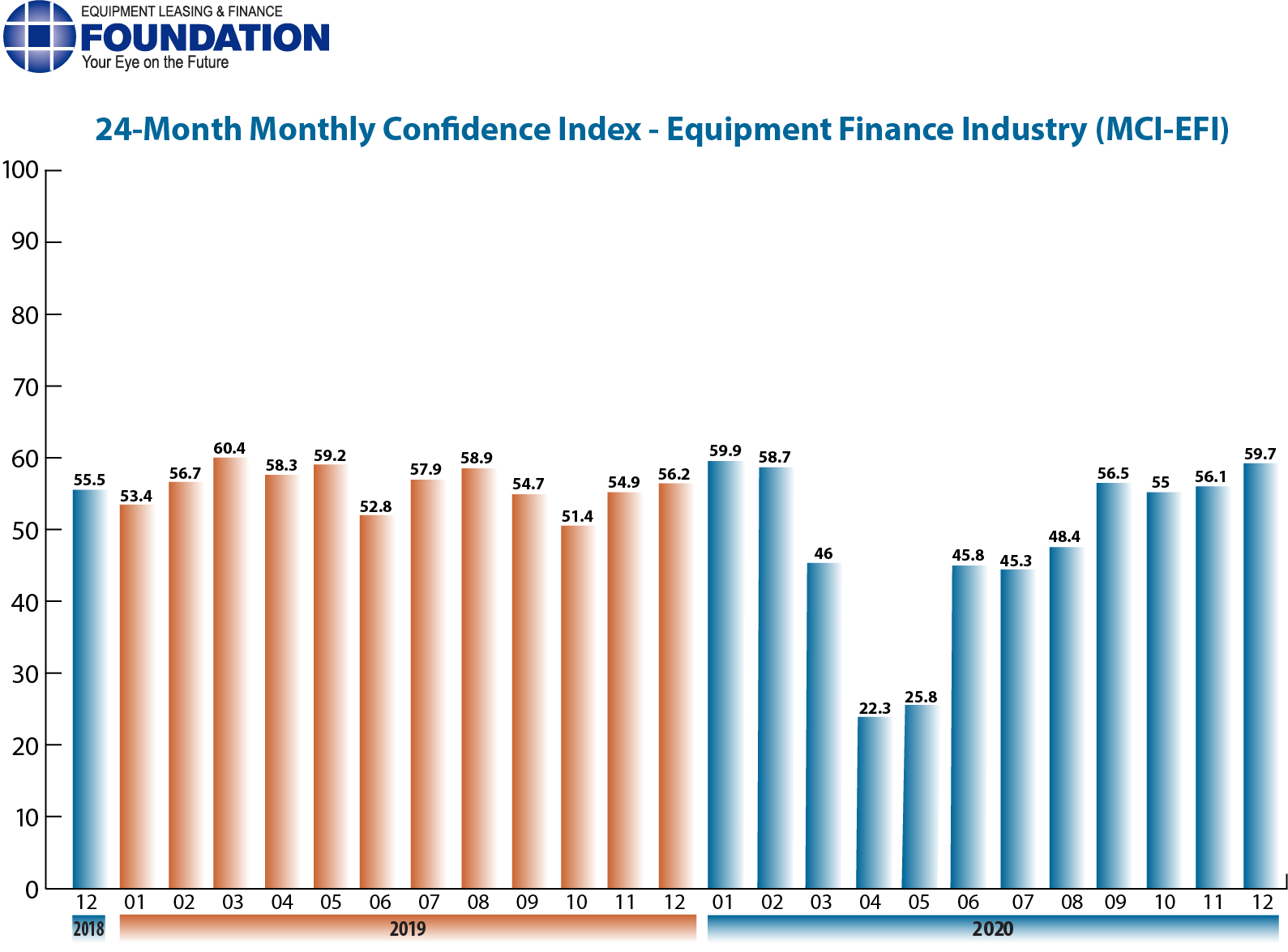

The Equipment Leasing & Finance Foundation (the Foundation) releases the December 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 59.7, an increase from the November index of 56.1.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Paul Tyczkowski, Senior Vice President Finance, LEAF Commercial Capital Inc., said, “While the COVID crisis continues to have significant impacts on businesses as we close out the year, there’s reason for cautious optimism now that the distribution of a highly effective vaccine is underway. Assuming distribution occurs as planned, I’m hopeful for a steady return to at least some level of normalcy in our lives and the economy during 2021.”

December 2020 Survey Results

The overall MCI-EFI is 59.7, an increase from the November index of 56.1.

- When asked to assess their business conditions over the next four months, 27.6% of executives responding said they believe business conditions will improve over the next four months, up from 26.9% in November. 62.1% believe business conditions will remain the same over the next four months, an increase from 53.9% the previous month. 10.3% believe business conditions will worsen, a decrease from 19.2% in November.

- 27.6% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 19.2% in November. 55.2% believe demand will “remain the same” during the same four-month time period, a decrease from 69.2% the previous month. 17.2% believe demand will decline, up from 11.5% in November.

- 24.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 23.1% in November. 75.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 76.9% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 31% of the executives report they expect to hire more employees over the next four months, up from 30.8% in November. 69% expect no change in headcount over the next four months, an increase from 57.7% last month. None expect to hire fewer employees, down from 11.5% in November.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 72.4 of the leadership evaluate the current U.S. economy as “fair,” down from 76.9% in November. 27.6% evaluate it as “poor,” up from 23.1% last month.

- 55.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 34.6% in November. 34.5% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 50% last month. 10.3% believe economic conditions in the U.S. will worsen over the next six months, down from 15.4% the previous month.

- In December 34.5 % of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 26.9% last month. 62.1% believe there will be “no change” in business development spending, a decrease from 69.2% in October. 3.5% believe there will be a decrease in spending, relatively unchanged from 3.9% last month.

December 2020 Survey Comments from Industry Executive Leadership

Independent, Middle Ticket

“The end to the pandemic is in sight, so while we need to navigate the next few months carefully, FY 2021 will undoubtedly improve as the year progresses.” Bruce J. Winter, President, FSG Capital, Inc

Bank, Middle Ticket

“Post-election it’s still uncertain how the political environment will impact longer-term plans for business investment. Hopefully the fiscal stimulus required to steady the current instability will be passed without much further delay.” Michael Romanowski, President, Farm Credit Leasing

Back to Top