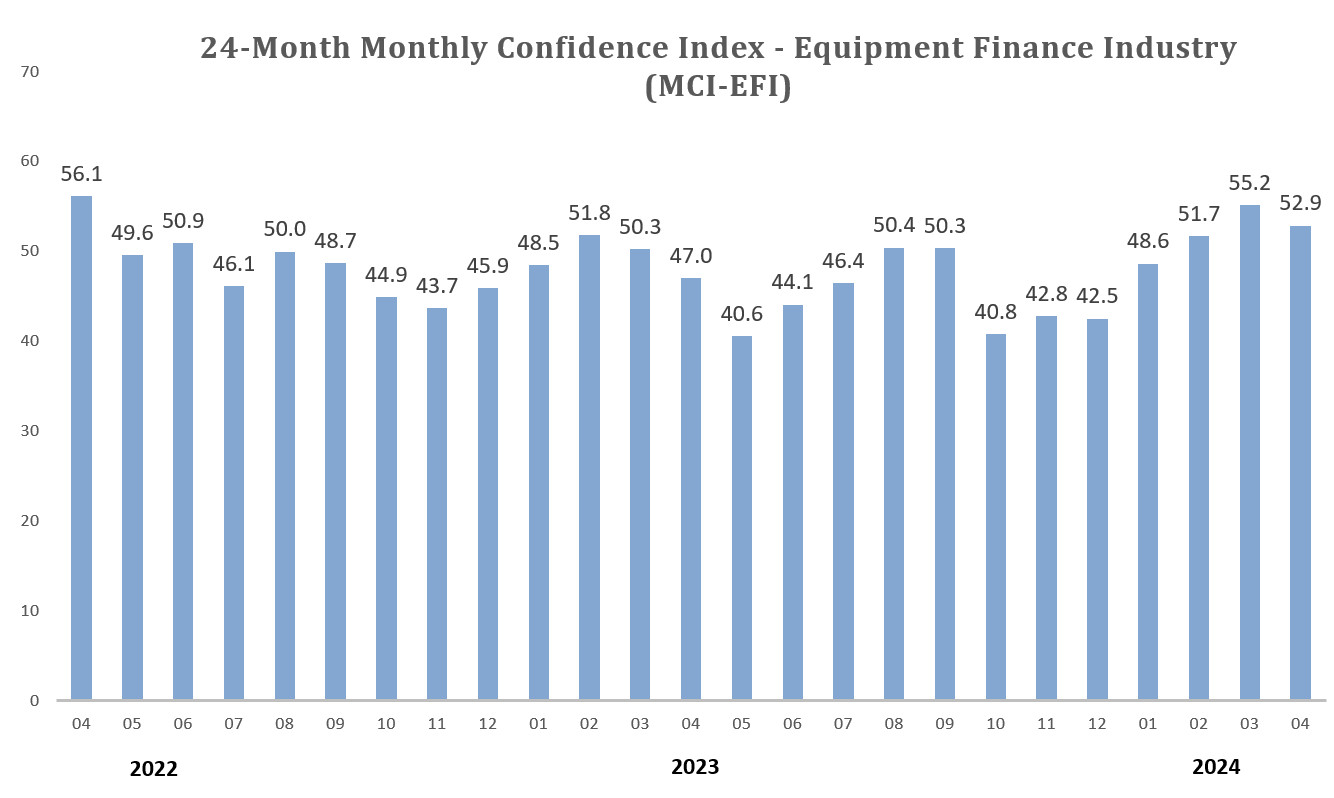

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 52.9, the second highest index in the last two years after last month’s index of 55.2.

When asked about the outlook for the future, MCI-EFI survey respondent Mark Bonanno, President and Chief Operating Officer, North Mill Equipment Finance, said, “Monetary policy has not been as effective in taming inflation that recently came in at an annual rate of 3.2%. The U.S. government as well as the consumer (via credit cards) have unsustainable debt levels, and that will eventually cause cracks in the economy.”

April 2024 Survey Results

The overall MCI-EFI is 52.9, a decrease from the March index of 55.2.

- When asked to assess their business conditions over the next four months, 10.7% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 19.4% in March. 85.7% believe business conditions will remain the same over the next four months, up from 77.4% the previous month. 3.6% believe business conditions will worsen, relatively unchanged from 3.2% in March.

- 7.1% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 25.8% in March. 92.9% believe demand will “remain the same” during the same four-month time period, up from 71% the previous month. None believe demand will decline, a decrease from 3.2% in March.

- 14.3% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 16.1% in March. 71.4% of executives indicate they expect the “same” access to capital to fund business, down from 74.2% last month. 14.3% expect “less” access to capital, up from 9.7% the previous month.

- When asked, 17.9% of the executives report they expect to hire more employees over the next four months, a decrease from 19.4% in March. 71.4% expect no change in headcount over the next four months, up from 67.7% last month. 10.7% expect to hire fewer employees, down from 12.9% in March.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 92.9% of the leadership evaluate the current U.S. economy as “fair,” down from 93.6% in March. 7.1% evaluate it as “poor,” up from 6.5% last month.

- 17.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 25.8% in March. 71.4% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 54.8% last month. 10.7% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 19.4% the previous month.

- In April, 17.9% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 22.6% the previous month. 78.6% believe there will be “no change” in business development spending, up from 64.5% in March. 3.6% believe there will be a decrease in spending, down from 12.9% last month.

Survey Demographics

Market Segment

- Bank 46.4%

- Captive 14.3%

- Independent 39.3%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 10.7%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 42.8%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 46.4%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 10.7%

- $50 Million – $250 Million 17.8%.

- $250 Million – $1 Billion 35.7%

- Over $1 Billion 35.7%

April 2024 Survey Comments from Industry Executive Leadership

Bank, Middle Ticket

“Our business is focused on agriculture and rural America. In many cases, ag producer profitability is down or expected to be down compared to the levels of recent years. This situation could make the cash flow and liquidity preservation benefits of a lease more attractive and valuable than they have been. The offset is that credit quality may be more of a challenge, but we expect it to remain quite manageable.” Jason Lueders, President, Farm Credit Leasing

Independent, Small Ticket

“The overspending by the Federal government is contributing greatly to driving up inflation.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Back to Top