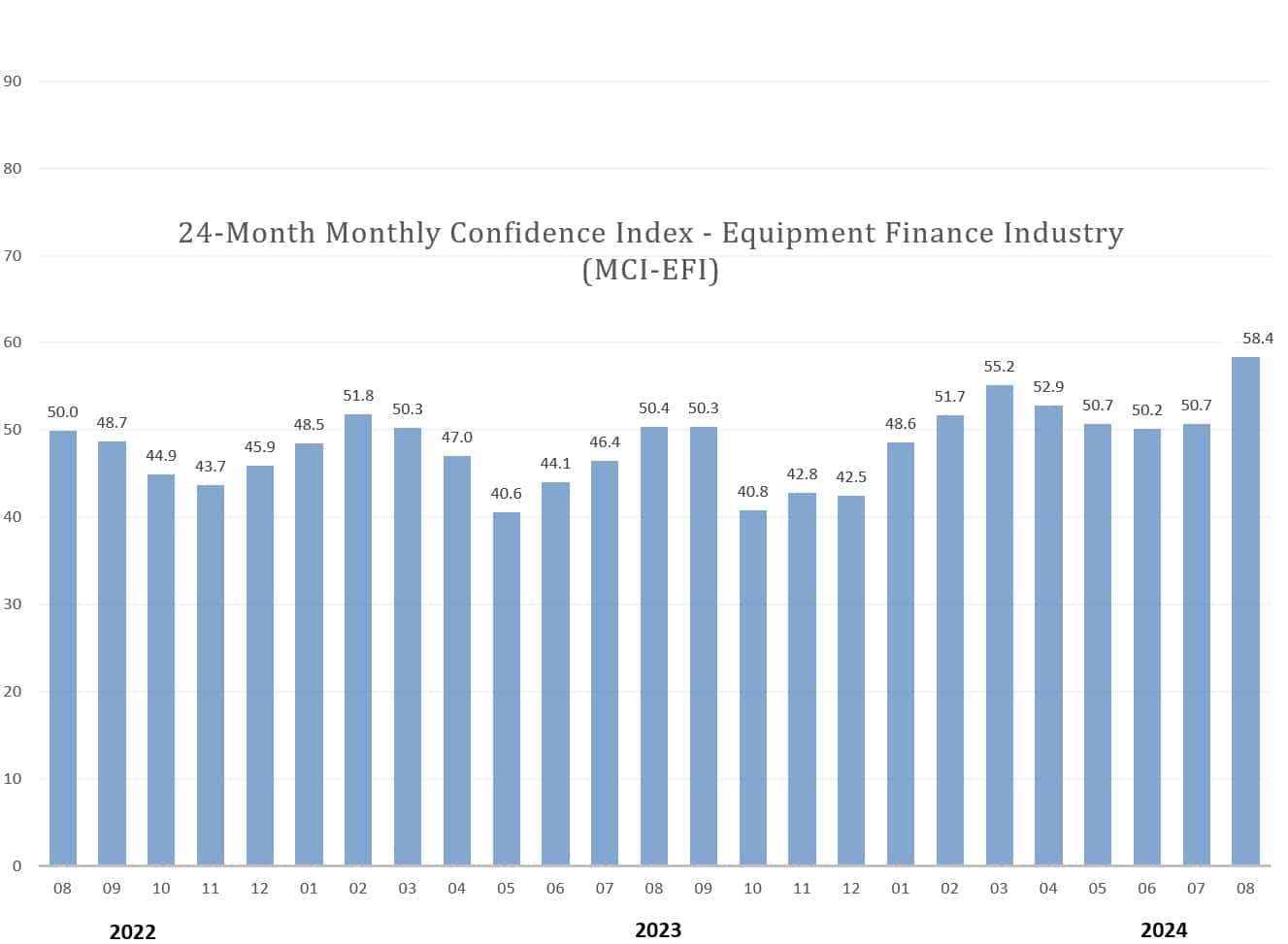

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 58.4, an increase from the July index of 50.7, and the highest level since February 2022. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Jeff Elliott, President of Huntington Equipment Finance, said, “Our overall confidence in the near-term future of the industry is high. We’re expecting economic conditions for businesses to improve over the next six months as interest rates decline and investment in U.S. manufacturing continues to grow, which in turn will lead to rising demand for funding to complete capex projects.”

August 2024 Survey Results

The overall MCI-EFI is 58.4, an increase from the July index of 50.7.

When asked to assess their business conditions over the next four months, 37.5% of the executives responding said they believe business conditions will improve over the next four months, an increase from 3.9% in July. 45.8% believe business conditions will remain the same over the next four months, down from 76.9% the previous month. 16.7% believe business conditions will worsen, down from 19.2% in July.

- 41.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 11.7% in July. 37.5% believe demand will “remain the same” during the same four-month time period, down from 73.1% the previous month. 20.8% believe demand will decline, an increase from 15.4% in July.

- 20.8% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 19.2% in July. 75% of executives indicate they expect the “same” access to capital to fund business, down from 76.9% last month. 4.2% expect “less” access to capital, relatively unchanged from 3.9% the previous month.

- When asked, 20.8% of the executives report they expect to hire more employees over the next four months, a decrease from 23.1% in July. 70.8% expect no change in headcount over the next four months, up from 69.2% last month. 8.3% expect to hire fewer employees, up from 7.7% in July.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 91.7% of the leadership evaluate the current U.S. economy as “fair,” up from 84.6% in July. 8.3% evaluate it as “poor,” down from 15.4% last month.

- 37.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 19.2% in July. 41.7% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 57.7% last month. 20.8% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 23.1% the previous month.

- In August, 33.3% of respondents indicated they believe their company will increase spending on business development activities during the next six months, an increase from 19.2% the previous month. 62.5% believe there will be “no change” in business development spending, down from 73.1% in July. 4.2% believe there will be a decrease in spending, down from 7.7% last month.

Survey Demographics

Market Segment

- Bank 58.3%

- Captive 8.3%

- Independent 33.3%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 12.5%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 17.2%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 58.3%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 12.5%

- $50 Million – $250 Million 20.8%.

- $250 Million – $1 Billion 29.1%

- Over $1 Billion 37.5%

August 2024 Survey Comments from Industry Executive Leadership

“Interest rates are expected to decrease shortly. Historically, when this happens, businesses tend to increase their capex spending. I believe there is pent-up demand in several sectors that are waiting for this interest rate reduction to happen. Interest rates typically impact transactional business, and equipment finance is one of those industries.” Donna Yanuzzi, EVP, 1st Equipment Finance, Inc. a division of Peoples Security Bank and Trust Company

Bank, Middle Ticket

“Leasing’s value proposition is strong in today’s economic environment. We are starting to see cracks emerge in some parts of our market, not in an alarming or unanticipated way, as we have been anticipating them for some time, but it is notable that we are finally seeing some weakness appear.” Jason Lueders, President, Farm Credit Leasing

Independent, Small Ticket

“The equipment finance industry ebbs and flows; it always has and always will. That said, it is a very resilient, creative and opportunistic industry, and rarely can get derailed. Many truly believe the best is yet to come as we navigate the winding road.” Adrian Hebig, Chief Corporate Development Officer, Channel

“I believe the worst is behind us now, and I expect the Fed Fund rate will be cut by a quarter of a point in September. Between now and the end of the year we should experience a gradual improvement in the economy.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Back to Top