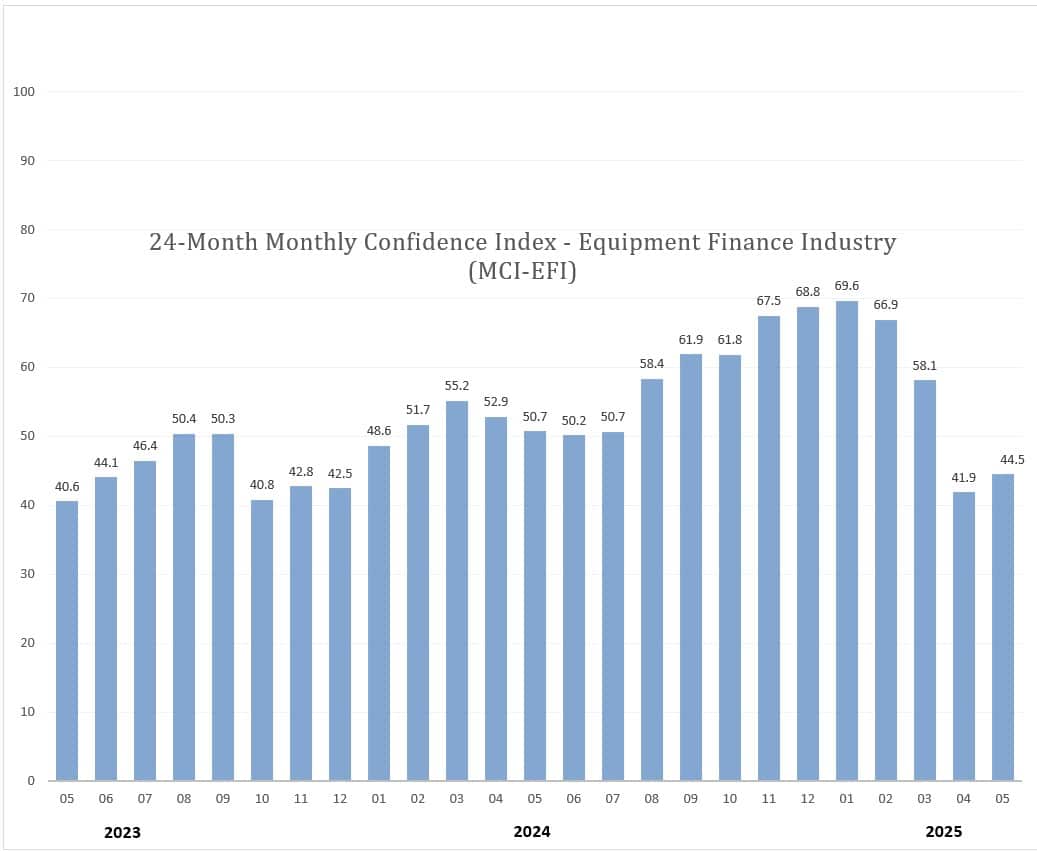

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2025 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 44.5, up from the April index of 41.9, and the second lowest index since December 2023. The index reports a qualitative assessment of both the prevailing business conditions and future expectations as reported by key executives from the $1.3 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Joseph Hines, Head of Equipment Finance, Trustmark Bank Equipment Finance, said, “Pipelines and funded business have picked up after a slow start to the year and a slower than expected year-end in 2024. Some of the uptick in new business may be a mix of new projects, maintenance capex, and pulling purchases forward due to tariff fears and rising costs. Time will tell how much of the new business are purchases being accelerated, but we remain optimistic the tariff discussions and outcomes will be positive and a return to some normalcy in the market.”

May 2025 Survey Results

The overall MCI-EFI is 44.5, up from the April index of 41.9.

- Business conditions – When asked to assess their business conditions over the next four months, 4% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 15.4% in April. 52% believe business conditions will remain the same over the next four months, up from 26.9% the previous month. 44% believe business conditions will worsen, down from 57.7% in April.

- Capex demand – 8% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 11.5% in April. 44% believe demand will “remain the same” during the same four-month time period, up from 26.9% the previous month. 48% believe demand will decline, a decrease from 61.5% in April.

- Access to capital – 4.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 7.7% in April. 95.8% of executives indicate they expect the “same” access to capital to fund business, up from 88.5% the previous month. None expect “less” access to capital, down from 3.9% in April.

- Employment – When asked, 24% of the executives report they expect to hire more employees over the next four months, an increase from 23.1% in April. 72% expect no change in headcount over the next four months, down from 73.1% last month. 4% expect to hire fewer employees, relatively unchanged from April.

- U.S. economy – None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from April. 84% evaluate the economy as “fair,” down from 88.5% the previous month. 16% evaluate it as “poor,” up from 11.5% in April.

- Economic outlook – 12% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 7.7% in April. 44% indicate they believe the U.S. economy will “stay the same” over the next six months, up from 34.6% last month. 44% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 57.7% the previous month.

- Business development spending – In May, 32% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 19.2% the previous month. 64% believe there will be “no change” in business development spending, a decrease from 80.8% in April. 4% believe there will be a decrease in spending, up from none from last month.

Survey Demographics

Market Segment

- Bank 50%

- Captive 16.6%

- Independent 33.3%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 8.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 45.8%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 45.8%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 8%

- $50 Million – $250 Million 20%.

- $250 Million – $1 Billion 32%

- Over $1 Billion 40%

May 2025 Survey Comments from Industry Executive Leadership

“As more trade partners come to the table, confidence in Trump’s aggressive trade policies increases. Combined with a bolstering of U.S. manufacturing, things should get better. The overall effect of tariffs is still being debated, but the consensus seems to be not as fatalistic as previously measured.” Charles Jones, Senior Vice President,1st Equipment Finance, Inc.

“The high level of uncertainty is driving confidence levels lower. At the same time, actual volume has been strong. So long as companies continue their investment in their businesses and finance more of those investments, 2025 could be a good year for the industry.” David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance

Back to Top