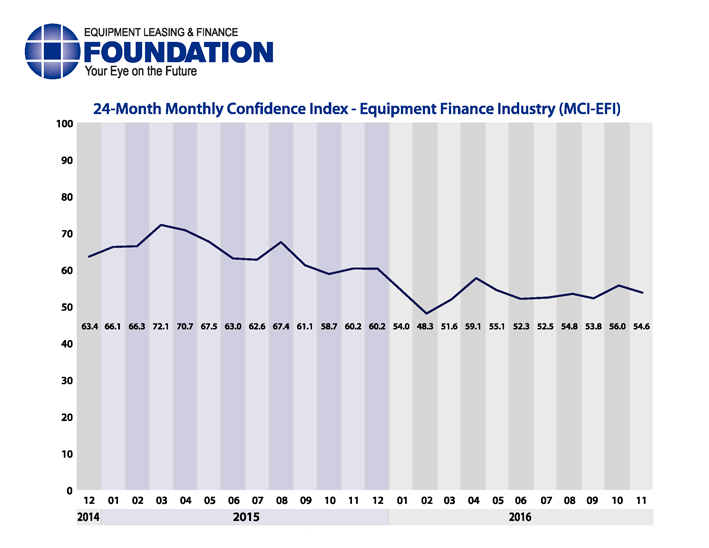

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 54.6, easing from the October index of 56.0. The majority of executives submitted their MCI survey responses prior to the U.S. elections.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, said post-election, “The industry continues to increase market share and develop new opportunities within commercial segments. Portfolios continue to perform well in spite of moderately increasing delinquency statistics. Now that the election is over, I hope that small and mid-size business owners decide to move forward on expansion projects that had been stalled due to uncertainty in Washington.”

November 2016 Survey Results

The overall MCI-EFI is 54.6, a decrease from the October index of 56.0.

- When asked to assess their business conditions over the next four months, 13.8% of executives responding said they believe business conditions will improve over the next four months, an increase from 12.1% in October. 69.0% of respondents believe business conditions will remain the same over the next four months, a decrease from 81.8% in October. 17.2% believe business conditions will worsen, an increase from 6.1% the previous month.

- 13.8% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 24.2% in October. 69.0% believe demand will “remain the same” during the same four-month time period, up from 57.6% the previous month. 17.2% believe demand will decline, down from 18.2% who believed so in October.

- 13.8% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 18.2% who expected more in October. 82.8% of executives indicate they expect the “same” access to capital to fund business, an increase from 75.8% the previous month. 3.4% expect “less” access to capital, a decrease from 6.1% last month.

- When asked, 34.5% of the executives report they expect to hire more employees over the next four months, an increase from 30.3% in October. 55.2% expect no change in headcount over the next four months, a decrease from 60.6% last month. 10.3% expect to hire fewer employees, up from 9.1% in October.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” an increase from 93.9% last month. None evaluate it as “poor,” a decrease from 6.1% in October.

- 17.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 15.2% in October. 65.5% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 69.7% the previous month. 17.2% believe economic conditions in the U.S. will worsen over the next six months, an increase from 15.2% who believed so last month.

- In November, 37.9% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 36.4% in October. 58.6% believe there will be “no change” in business development spending, a decrease from 63.6% the previous month. 3.4% believe there will be a decrease in spending, an increase from none who believed so last month.

Survey Demographics

Market Segment:

- Bank: 67.9%

- Captive: 3.6%

- Financial Services: 7.1%

- Independent: 21.4%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 14.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 42.9%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 42.9%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2014):

- Under $50 Million: 7.1%

- $50 Million – $250 Million: 17.9%

- $250 Million – $1 Billion: 32.1%

- Over $1 Billion: 42.9%

November 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Bank, Small Ticket

“The equipment finance industry is dynamic and we will continue to adapt to political change, accounting changes, regulation change and changes in the economy. I am optimistic about the future of the industry because of the talented and innovative people in it.” David Normandin, Managing Director, Commercial Finance Group, Banc of California

Bank, Middle Ticket

“While demand for equipment financing on a national scope is tepid, regional and industry demand is still vibrant. Select areas of the country are continuing to grow. This growth stems from population movement to more business-friendly locations.” Harry Kaplun, President, Specialty Finance, Frost Bank

Bank, Middle Ticket

“We expect agriculture to lag the overall economy with capital expenditures due to low commodity prices and other factors impacting the agriculture sector.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Back to Top