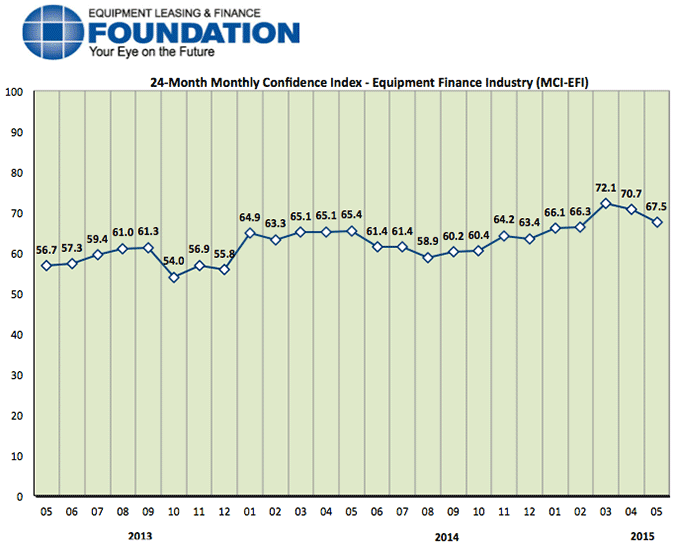

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 67.5, slightly lower than the April index of 70.7.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, Inc., said, “We are experiencing strong application volume, which we attribute to more of our customers deciding to move forward with projects that have been “on hold.” Competition is brisk in the marketplace, but equipment financing seems to be the preferred method of acquisition in this quarter.”

May 2015 Survey Results

The overall MCI-EFI is 67.5, slightly lower than the April index of 70.7.

- When asked to assess their business conditions over the next four months, 30.8% of executives responding said they believe business conditions will improve over the next four months, down from 44.4% in April. 69.2% of respondents believe business conditions will remain the same over the next four months, up from 55.6% in April. None believe business conditions will worsen, unchanged from the previous month.

- 34.6% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 48.2% in April. 65.4% believe demand will “remain the same” during the same four-month time period, up from 51.9% the previous month. None believe demand will decline, unchanged from April.

- 38.5% of executives expect more access to capital to fund equipment acquisitions over the next four months, up from 25.9% in April. 57.7% of survey respondents indicate they expect the “same” access to capital to fund business, down from 74.1% in April. 3.9% expect “less” access to capital, up from none who expected less access to capital the previous month.

- When asked, 53.9% of the executives reported they expect to hire more employees over the next four months, an increase from 51.9% in April. 42.3% expect no change in headcount over the next four months, down from 48.2% last month. 3.9% expect to hire fewer employees, up from none who expected fewer in April.

- 3.9% of the leadership evaluate the current U.S. economy as “excellent,” down from 7.4% last month. 96.2% of the leadership evaluate the current U.S. economy as “fair,” up from 92.6% in April. None rate it as “poor,” unchanged from the previous month.

- 34.6% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 40.7% who believed so in April. 65.4% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 55.6% in April. None believe economic conditions in the U.S. will worsen over the next six months, a decrease from 3.7% who believed so last month.

- In May, 50% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 59.3% in April. 46.2% believe there will be “no change” in business development spending, an increase from 40.7% last month. 3.9% believe there will be a decrease in spending, an increase from none who believed so last month.

Survey Demographics

Market Segment:

- Bank: 66.2%

- Captive: 3.8%

- Financial Services: 7.7%

- Independent: 19.2%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 11.5%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 50.0%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 38.5%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 7.7%

- $50 Million – $250 Million: 11.5%

- $250 Million – $1 Billion: 30.8%

- Over $1 Billion: 50.0%

May 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Based on our pool of approved applications Q2 should moderately outpace Q1. Job growth is still too slow to generate robust originations, especially considering new entrants into the marketplace.” David Schaefer, CEO, Mintaka Financial, LLC

Independent, Middle Ticket

“[We see a] continued increase in new business financing opportunities, especially in the truck market.” William Besgen, President & COO, Hitachi Capital America Corp.

Bank, Middle Ticket

“We continue to see investment in the industries that we serve (agriculture and rural infrastructure), but customers are more cautious with investment than past years primarily due to depressed commodity prices and California drought.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Back to Top