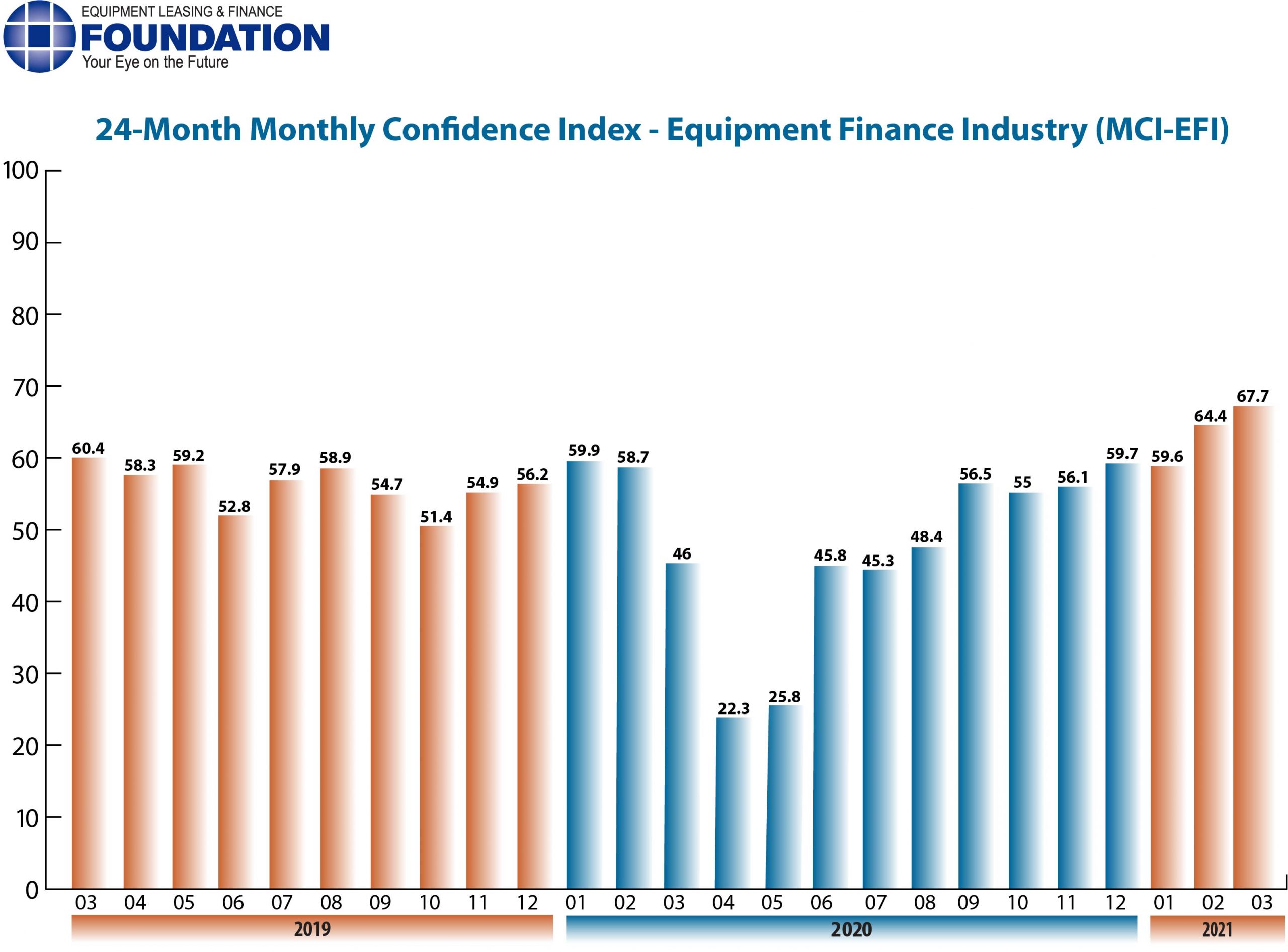

The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 67.7, an increase from the February index of 64.4, and the highest level since April 2018.

When asked about the outlook for the future, MCI-EFI survey respondent David Drury, Senior Vice President and Head of Equipment Finance, Fifth Third Bank, said, “We are relatively positive on domestic and global economic activity for this year, and likely next. Despite lingering disruptions, with the tailwinds of government stimulus, central bank liquidity, excess capacity, and pent-up demand, global economic growth may positively surprise in 2021. The big question that could change our mind would be a return of inflation, which would change the dovish nature of most global central banks. Higher inflation would lead to higher interest rates and less of an incentive for businesses to borrow and invest.”

March 2021 Survey Results

The overall MCI-EFI is 67.7, an increase from the February index of 64.4.

- When asked to assess their business conditions over the next four months, 50% of executives responding said they believe business conditions will improve over the next four months, up from 46.2% in February. 46.4% believe business conditions will remain the same over the next four months, unchanged from the previous month. 3.6% believe business conditions will worsen, a decrease from 7.7% in February.

- 42.9% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, 53.6% believe demand will “remain the same” during the same four-month time period, and 3.6% believe demand will decline, all relatively unchanged from February.

- 28.6% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 23.1% in February. 71.4% of executives indicate they expect the “same” access to capital to fund business, a decrease from 76.9% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 42.9% of the executives report they expect to hire more employees over the next four months, up from 38.5% in February. 57.1% expect no change in headcount over the next four months, a decrease from 61.5% last month. None expect to hire fewer employees, unchanged from February.

- 3.6% of the leadership evaluate the current U.S. economy as “excellent,” an increase from none the previous month. 78.6% of the leadership evaluate the current U.S. economy as “fair,” up from 76.9% in February. 17.9% evaluate it as “poor,” down from 23.1% last month.

- 60.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 50% in February. 32.1% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 38.5% last month. 7.1% believe economic conditions in the U.S. will worsen over the next six months, down from 11.5% the previous month.

- In March 39.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 30.8% last month. 60.7% believe there will be “no change” in business development spending, a decrease from 69.2% in February. None believe there will be a decrease in spending, unchanged from last month.

March 2021 Survey Comments from Industry Executive Leadership

Bank, Middle Ticket

“The prospect of a broadly-vaccinated population should further push open state and local economies.” Adam Warner, President, Key Equipment Finance

Independent, Middle Ticket

“The vaccine rollout is now progressing quickly, and while some predict we won’t see the end of this pandemic until year end, I believe everyone that wants a vaccine will be able to receive one by early May. This bodes well for the return of strong economic activity that will almost certainly boost capital spending significantly.” Bruce J. Winter, President, FSG Capital, Inc.

Independent, Large Ticket

“As COVID restrictions lift and companies have a clearer vision of future demand, it will help companies make more informed capex decisions.” Vincent Belcastro, Group Head Syndications, Element Fleet Management

Back to Top