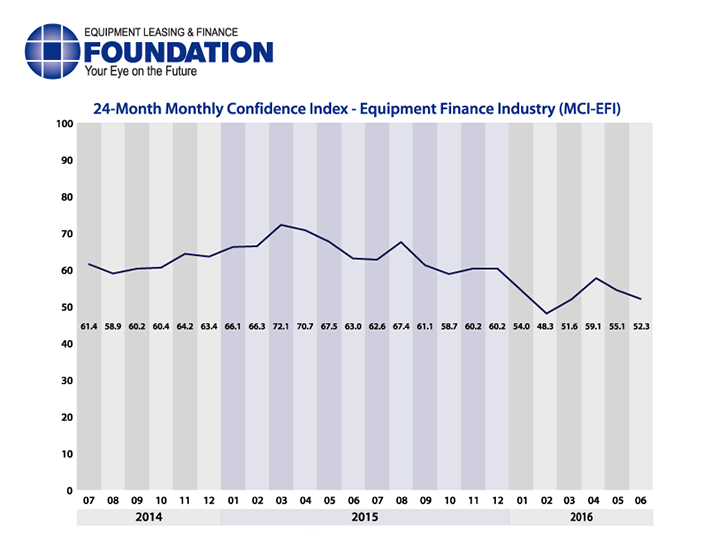

The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market eased for the second consecutive month to 52.3 from the May index of 55.1. Uncertainty about the November election and its impact on the U.S. economy were among respondents’ concerns.

When asked about the outlook for the future, MCI-EFI survey respondent Robert Boyer, President, Susquehanna Commercial Finance, said, “Increased consumer spending and confidence indications create some level of optimism, but 2016 capital investment will be heavily impacted by the uncertainty caused by the November election.”

June 2016 Survey Results

The overall MCI-EFI is 55.1, a decrease from the April index of 59.1.

- When asked to assess their business conditions over the next four months, 9.4% of executives responding said they believe business conditions will improve over the next four months, a decrease from 16.1% in May. 68.8% of respondents believe business conditions will remain the same over the next four months, an increase from 67.7% in May. 21.9% believe business conditions will worsen, an increase from 16.1% the previous month.

- 6.3% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 16.1% in May. 71.9% believe demand will “remain the same” during the same four-month time period, up from 61.3% the previous month. 21.9% believe demand will decline, relatively unchanged from 22.6% who believed so in May.

- 15.6% of executives expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 19.4% in May. 81.3% of survey respondents indicate they expect the “same” access to capital to fund business, an increase from 74.2% the previous month. 3.1% expect “less” access to capital, a decrease from 6.5% last month.

- When asked, 37.5% of the executives report they expect to hire more employees over the next four months, a decrease from 48.4% in May. 56.3% expect no change in headcount over the next four months, an increase from 48.4% last month. 6.3% expect to hire fewer employees, an increase from 3.2% in May.

- None of the leadership evaluates the current U.S. economy as “excellent,” unchanged from last month. 96.9% of the leadership evaluate the current U.S. economy as “fair” and 3.1% rate it as “poor,” both unchanged from May.

- 6.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, unchanged from May. 75.0% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 64.5% the previous month. 18.8% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 29.0% who believed so last month.

- In June, 31.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 38.7% in May. 68.8% believe there will be “no change” in business development spending, an increase from 58.1% the previous month. None believe there will be a decrease in spending, a decrease from 3.2% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 62.5%

- Captive: 9.4%

- Financial Services: 3.1%

- Independent: 25.0%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 15.6%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 43.8%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 40.6

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.3%

- $50 Million – $250 Million: 12.5%

- $250 Million – $1 Billion: 37.5%

- Over $1 Billion: 43.8%

June 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Rates remain low, capital is abundant, and credit appetites appear to be widening—all good news for would-be borrowers. On the other hand, we are experiencing a political environment that seems circus-like and a nation that is being rocked by threats of terrorism. We do not expect to see small and mid-size businesses choosing to expand and invest with certainty. I believe the rest of this year will see a reasonable flow of business, but I’m not expecting a strong close to 2016.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Bank, Small Ticket

“Abundant liquidity, which increases competition and lowers spreads, is still the biggest story in our industry. The presidential election will keep a damper on economic expansion through the remainder of the year.” Paul Menzel, President and CEO, Financial Pacific Leasing, LLC

Bank, Middle Ticket

“Year to date, the equipment finance industry has seen substantial decreases in new business activity compared to 2015. Given the choppy performance of the U.S. economy and political uncertainty I believe the balance of 2016 will be similar to the first half; not an optimistic outlook for the industry.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top