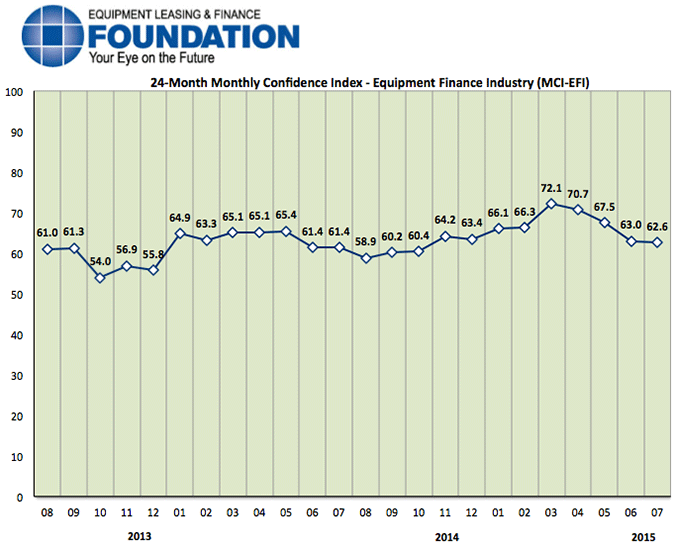

The Equipment Leasing & Finance Foundation (the Foundation) releases the July 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 62.6, remaining essentially the same as the June index of 63.0.

When asked about the outlook for the future, MCI-EFI survey respondent David T. Schaefer, CEO, Mintaka Financial, LLC, said, “New applications for leases and loans increased significantly in the latter half of the second quarter. If this trend continues we would have a record third quarter post-recession. I’m moderately optimistic as we have experienced unsustained bursts in the recent past.”

July 2015 Survey Results

The overall MCI-EFI is 62.6, essentially the same as the June index of 63.0.

- When asked to assess their business conditions over the next four months, 17.2% of executives responding said they believe business conditions will improve over the next four months, relatively unchanged from 17.9% in June. 75.9% of respondents believe business conditions will remain the same over the next four months, a decrease from 82.1% in June. 6.9% believe business conditions will worsen, an increase from none who believed so the previous month.

- 20.7% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down slightly from 21.4% in June. 72.4% believe demand will “remain the same” during the same four-month time period, down from 78.6% the previous month. 6.9% believe demand will decline, an increase from none who believed so in June.

- 20.7% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 25% in June. 79.3% of survey respondents indicate they expect the “same” access to capital to fund business, up from 75% in June. None expect “less” access to capital, unchanged from the previous month.

- When asked, 51.7% of the executives report they expect to hire more employees over the next four months, a decrease from 57.1% in June. 48.3% expect no change in headcount over the next four months, up from 35.7% last month. None expect to hire fewer employees, down from 7.1% who expected fewer in June.

- 13.8% of the leadership evaluate the current U.S. economy as “excellent,” an increase from 3.6% last month. 82.8% of the leadership evaluate the current U.S. economy as “fair,” down from 96.4% in June. 3.5% rate it as “poor,” an increase from none the previous month.

- 24.1% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 28.6% who believed so in June. 69% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 67.9% in June. 6.9% believe economic conditions in the U.S. will worsen over the next six months, an increase from 3.6% who believed so last month.

- In July, 48.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 35.7% in June. 51.7% believe there will be “no change” in business development spending, a decrease from 60.7% last month. None believe there will be a decrease in spending, down from 3.6% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 65.5%

- Captive: 6.9%

- Financial Services: 10.3%

- Independent: 17.2%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 10.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 55.2%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 34.5%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.9%

- $50 Million – $250 Million: 10.3%

- $250 Million – $1 Billion: 34.5%

- Over $1 Billion: 46.4%

July 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Demand continues to remain consistent. We still experience a reluctance on the part of small business owners to consider acquiring equipment that will help grow their business as opposed to replacement equipment. Mid-size and larger companies continue to remain fairly bullish on investment opportunities. Abundant capital and low delinquency statistics continue to keep rates and margins under pressure.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Bank, Small Ticket

“I believe that there continues to be pent-up demand for capital equipment investment while there is also expectation of higher rates in the future. This can be a powerful combination for growth in our industry.” Paul Menzel, President & CEO, Financial Pacific Leasing, LLC

Bank, Middle Ticket

“Capital expenditures for equipment continue to ramp upward in almost all sectors. Favorable market conditions, low interest rates and ample capital availability are the driving factors.” Harry Kaplun, President, Frost Equipment Leasing and Finance

Back to Top