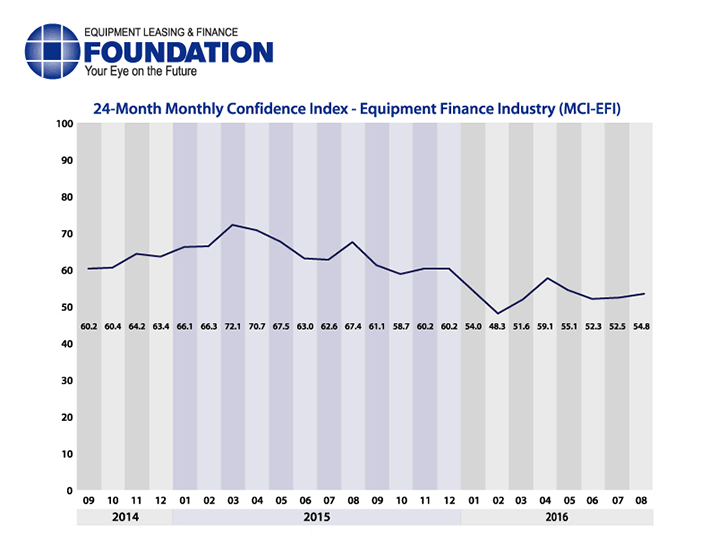

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 54.8, an increase from the July index of 52.5.

When asked about the outlook for the future, MCI-EFI survey respondent Adam D. Warner, President, Key Equipment Finance, said, “There seems to be a general slowdown in capital asset acquisitions. There is enough negative overhang and fallout from the U.S. presidential campaign combined with continued concerns about Europe and China that have businesses unsure about investments in growth.”

August 2016 Survey Results

The overall MCI-EFI is 54.8, an increase from the July index of 52.5.

- When asked to assess their business conditions over the next four months, 10.0% of executives responding said they believe business conditions will improve over the next four months, a decrease from 12.1% in July. 80.0% of respondents believe business conditions will remain the same over the next four months, an increase from 75.8% in July. 10.0% believe business conditions will worsen, a decrease from 12.1% the previous month.

- 13.3% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 12.1% in July. 70.0% believe demand will “remain the same” during the same four-month time period, up from 57.6% the previous month. 16.7% believe demand will decline, a decrease from 30.3% who believed so in July.

- 13.3% of executives expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 15.2% in July. 80.0% of survey respondents indicate they expect the “same” access to capital to fund business, an increase from 78.8% the previous month. 6.7% expect “less” access to capital, an increase from 6.1% last month.

- When asked, 40.0% of the executives report they expect to hire more employees over the next four months, an increase from 30.3% in July. 50.0% expect no change in headcount over the next four months, a decrease from 63.6% last month. 10.0% expect to hire fewer employees, up from 6.1% in July.

- None of the leadership evaluates the current U.S. economy as “excellent,” unchanged from last month. 90.0% of the leadership evaluate the current U.S. economy as “fair,” a decrease from 100% last month. 10% evaluate it as “poor,” an increase from none in July.

- None of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 3.0% in July. 96.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 78.8% the previous month. 3.3% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 18.2% who believed so last month.

- In August, 40.0% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 36.4% in July. 60.0% believe there will be “no change” in business development spending, relatively unchanged from 60.6% the previous month. None believe there will be a decrease in spending, a decrease from 3.0% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 64.3%

- Captive: 3.6%

- Financial Services: 3.6%

- Independent: 28.6%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 14.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 42.9%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 42.9

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 7.1%

- $50 Million – $250 Million: 25.0%

- $250 Million – $1 Billion: 32.1%

- Over $1 Billion: 35.7%

August 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Bank, Small Ticket

“I am concerned about slow to no growth in an election year with increasing delinquency and bad debt. Consolidation brings opportunities on a small scale and is challenging on a large scale.” David Normandin, Managing Director, Commercial Finance Group, Banc of California

Independent, Middle Ticket

“While the employment numbers look positive, the recent GDP number seems anemic. Growth in new business volumes has softened and there is a slight uptick in delinquencies, despite aggressive collections efforts. The outlook is unclear.” William H. Besgen, Senior Advisor, Vice Chairman Emeritus, Hitachi Capital America Corp.

Bank, Middle Ticket

“We continue to see a pull-back in capital investment for the sectors we serve, especially the cash grain sector. We continue to see opportunities with solar and facility-based financing for those customers looking to take advantage of tax credits and growth opportunities for industries not impacted by low commodity prices.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Bank, Large Ticket

Though the market remains competitive, we continue to see financing opportunities from our client base. Concerns over the outcome of the elections could impact spending in the short term.” Thomas Partridge, President, Fifth Third Equipment Finance

Back to Top