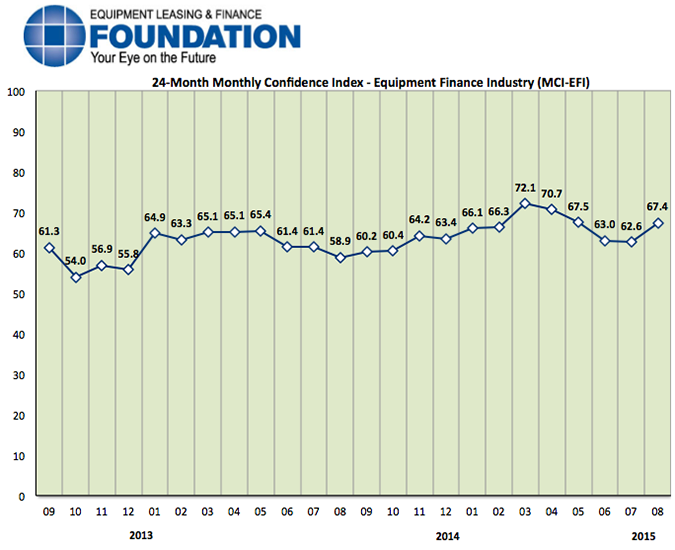

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 67.4, rising sharply against the July index of 62.6.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, Inc., said, “Demand has stayed strong through the summer. The threat of potentially increasing interest rates and projects that have been delayed for too long have been principal motivators for our customers. I feel optimism is fueled by economic conditions improving and by consumer sentiment that seems to echo that positive attitude.

August 2015 Survey Results

The overall MCI-EFI is 67.4, higher than the July index of 62.6.

- When asked to assess their business conditions over the next four months, 36.4% of executives responding said they believe business conditions will improve over the next four months, an increase from 17.2% in July. 63.6% of respondents believe business conditions will remain the same over the next four months, a decrease from 75.9% in July. None believe business conditions will worsen, a decrease from 6.9% who believed so the previous month.

- 40.9% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 20.7% in July. 59.1% believe demand will “remain the same” during the same four-month time period, down from 72.4% the previous month. None believe demand will decline, a decrease from 6.9% who believed so in July.

- 31.8% of executives expect more access to capital to fund equipment acquisitions over the next four months, up from 20.7% in July. 68.2% of survey respondents indicate they expect the “same” access to capital to fund business, down from 79.3% in July. None expect “less” access to capital, unchanged from the previous month.

- When asked, 36.4% of the executives report they expect to hire more employees over the next four months, a decrease from 51.7% in July. 63.6% expect no change in headcount over the next four months, up from 48.3% last month. None expect to hire fewer employees, unchanged from July.

- 4.5% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 13.8% last month. 95.5% of the leadership evaluate the current U.S. economy as “fair,” up from 82.8% in July. None rate it as “poor,” a decrease from 3.5% the previous month.

- 27.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 24.1% who believed so in July. 68.2% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, relatively unchanged from 69% in July. 4.5% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 6.9% who believed so last month.

- In August, 54.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 48.3% in July. 45.5% believe there will be “no change” in business development spending, a decrease from 51.7% last month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment:

- Bank: 72.7%

- Captive: 0.0%

- Financial Services: 4.5%

- Independent: 22.7%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 9.1%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 50.0%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 40.9%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 9.1%

- $50 Million – $250 Million: 13.6%

- $250 Million – $1 Billion: 36.4%

- Over $1 Billion: 40.9%

August 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Bank, Small Ticket

“Concerns still circle in Washington, D.C., on regulatory matters, as well as unrest around the world.” Kenneth Collins, CEO, Susquehanna Commercial Finance, Inc.

Independent, Middle Ticket

“I have concerns about the impact on people’s confidence from China’s devaluation of its currency and the decreasing price of oil—both deflationary—and the overhang of the Fed possibly raising interest rates in the near term.” William H. Besgen, Vice Chairman, Board of Directors, Hitachi Capital America Corp.

Bank, Middle Ticket

“A rise in interest rates could force an uptick in economic activity. If so, the equipment finance industry could finish 2015 on a very strong note.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top