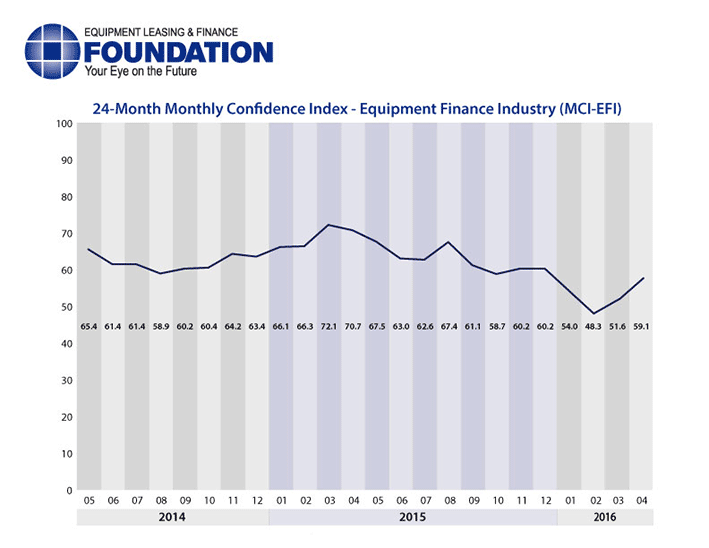

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market increased for the second consecutive month to 59.1, an increase from the March index of 51.6.

When asked about the outlook for the future, MCI-EFI survey respondent Aylin Cankardes, President and Founder, Rockwell Financial Group, said, “The favorable rate environment is still driving growth in the equipment finance sector. Focusing on customers where margin and broader opportunity exists continues to be our top priority. The key drivers are providing innovative and solution driven options to generate value.”

April 2016 Survey Results

The overall MCI-EFI is 59.1, an increase from the March index of 51.6.

- When asked to assess their business conditions over the next four months, 12.1% of executives responding said they believe business conditions will improve over the next four months, an increase from 3.2% in March. 75.8% of respondents believe business conditions will remain the same over the next four months, a decrease from 77.4% in March. 12.1% believe business conditions will worsen, a decrease from 19.4% the previous month.

- 15.2% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 9.7% in March. 66.7% believe demand will “remain the same” during the same four-month time period, down from 74.2% the previous month. 18.2% believe demand will decline, an increase from 16.1% who believed so in March.

- 24.2% of executives expect more access to capital to fund equipment acquisitions over the next four months, increase from 16.1% in March. 75.8% of survey respondents indicate they expect the “same” access to capital to fund business, a decrease from 77.4% the previous month. None expect “less” access to capital, a decrease from 6.5% last month.

- When asked, 51.5% of the executives report they expect to hire more employees over the next four months, an increase from 32.3% in March. 45.5% expect no change in headcount over the next four months, a decrease from 61.3% last month. 3.0% expect to hire fewer employees, a decrease from 6.5% in March.

- 3.0% of the leadership evaluate the current U.S. economy as “excellent,” an increase from none last month. 97% of the leadership evaluate the current U.S. economy as “fair,” down from 100% in March. None rate it as “poor,” unchanged from the previous month.

- 3.0% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from none who believed so in March. 87.9% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 77.4% the previous month. 9.1% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 22.6% who believed so last month.

- In April, 54.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 38.7% in March. 45.5% believe there will be “no change” in business development spending, a decrease from 48.4% the previous month. None believe there will be a decrease in spending, a decrease from 12.9% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 63.6%

- Captive: 6.1%

- Financial Services: 3.0%

- Independent: 27.3%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 15.2%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 42.4%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 42.4%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.1%

- $50 Million – $250 Million: 18.2%

- $250 Million – $1 Billion: 30.3%

- Over $1 Billion: 45.5%

April 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Application activity is on pace for the year but we see trends in customers seeking credit approvals that we cannot deliver, such as transactions for closely held entities that offer no personal guarantees and demand for rates that are unrealistic in the small ticket space. The absurdity of the current election coupled with heightened concern for the future and increased terrorist activity seem to be having a strong impact on our customers’ mentality. Closing transactions is much harder than it was a year ago.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Independent, Middle Ticket

“Our new business volumes from our smaller ticket middle market customers, especially our medium duty truck users, continue to be strong, evidencing continued optimism in local economies across the U.S.” William H. Besgen, Senior Advisor, Vice Chairman Emeritus, Hitachi Capital America Corp.

Bank, Middle Ticket

“The U.S. economy continues to lack any positive momentum. Because of the uncertain economic environment companies continue to take a very conservative approach to capital expenditures. This is compounded by the severe downturn in the energy markets, which have historically been very active in the equipment finance market. Unfortunately, I believe the near term prospects for equipment finance are for reduced levels of activity compared to prior years.” Thomas Jaschik, President, BB&T Equipment Finance.

Bank, Large Ticket

“The continued low rate environment makes it attractive to finance equipment needs. The biggest concerns are cyclical industries which are showing signs of a downturn.” Thomas Partridge, President, Fifth Third Equipment Finance.

Back to Top