ELFA and the Foundation are unifying their research efforts. Starting in February 2026, all industry data and reports are available on the ELFA website.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor consists of indices for seven equipment and software investment verticals.

These indices are designed to identify turning points in their respective investment cycles with a 3 to 6 month lead time for the following verticals:

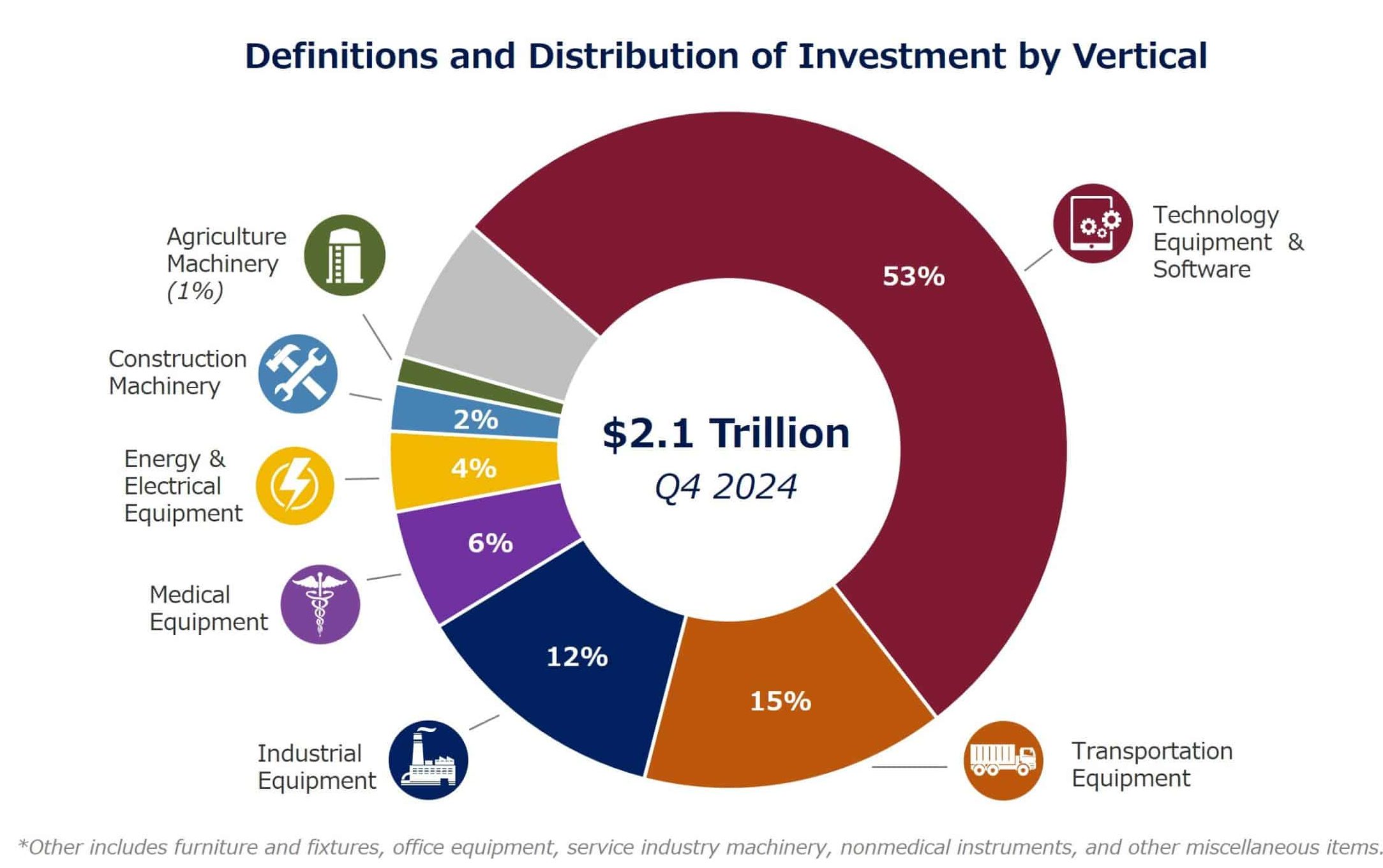

The Foundation consolidated several equipment verticals while also incorporating new types of equipment that have not previously been tracked. Specifically, the number of equipment verticals has been condensed from 12 to 7, including Agriculture, Construction, Energy & Electrical, Industrial, Medical, Technology, and Transportation. Collectively, these verticals account for over 90% of U.S. equipment and software investment.